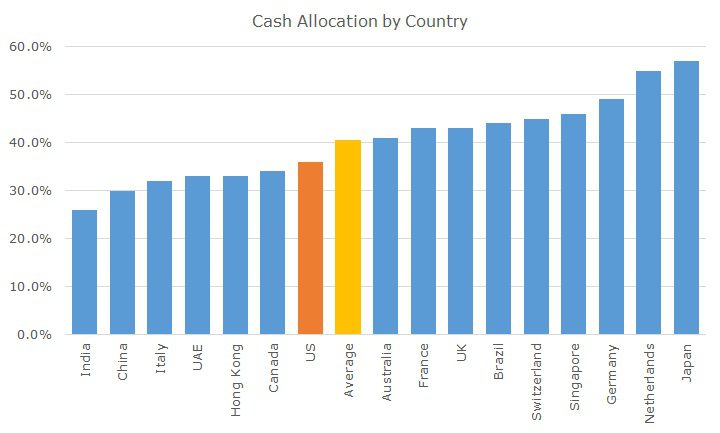

A recent report by State Street’s Center for Applied Research recently found that individual investors favor cash the world over. In the US, investors keep 36 percent of their investible assets in cash. Globally, that’s a little less than average.

I have to admit that I was shocked by these numbers. I know that during times of crisis, people frequently say that cash is king, but I really think that cash is trash. Yes, you need some on the side in case of emergency, but that’s not really an investment, it’s a bit of prudent insurance.

The argument against cash isn’t very complicated – the returns stink.

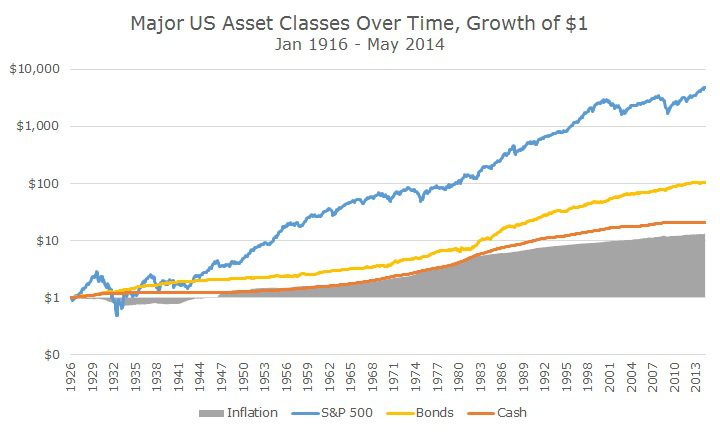

Over the long run, cash has barely kept pace with inflation, earning 3.48 percent versus 2.97 percent for the Consumer Price Index (CPI). Given what the Federal Reserve has done to interest rates in the recent years, one-month US Treasury bills (our proxy for cash), hasn’t even kept pace with inflation.

During the last 10-years, for example, bills earned 1.51 percent and cash earned 2.35 percent. Over shorter periods, cash gets even worse, falling down to less than 0.10 percent while inflation has remained around two percent.

The appeal of cash must be that it doesn’t lose money. Since 1926, the worst 12-month return for cash was -0.04 percent back in 1938-39. By comparison, the worst one-year period for bonds was -5.56 percent in 1993-94 and for stocks was -67.57 back in 1931-32.

This is actually an important point. If your time horizon is short, then cash really is king. If you may be buying a house in the next year or need the money for any reason, then cash really is the best option.

Clients routinely tell me that they will need cash in a few months and want to give me the flexibility to time the market when raising their cash. Since I know that I can’t time the market effectively, I almost always raise the money as soon as practical.

If the timing is uncertain or the client has other money they can use, then it might vary, but, in general, my goal is to raise the money so that it’s all available. I know that markets can turn in a hurry and don’t want an unforeseen circumstance to disrupt someone’s plans.

For longer-term periods, though, cash is a poor investment. We maintain a small allocation because cash is always coming into the account through dividends and interest, but it’s a small portion of the account.

And unlike actively managed mutual funds, the products that we use are fully invested in their intended strategy – it’s never the case that a mutual fund is 20 percent cash because the manager doesn’t like stocks or something like that.

We don’t have just history on our side either – stocks and bonds should earn more than cash over the long-run for good reason. Stocks and bonds are riskier than cash and investors need to be compensated for the additional risk.

You can see in the chart above that returns for stocks and bonds have been a lot better than cash, but the risk is higher too. The volatility of bonds is about five times higher than cash and stocks are about four times more volatile than bonds, making stocks 21 times more volatile than cash.

As always, risk and return go hand in hand.