Stocks sold off sharply this week, as noted above, mostly because markets had anticipated good news on the inflation front and didn’t get it.

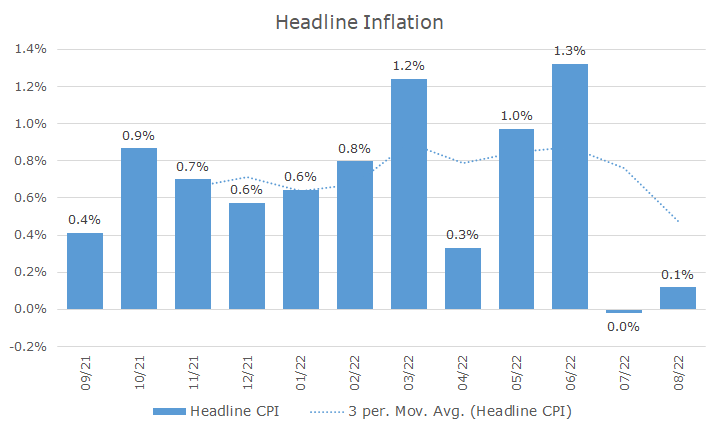

When I first saw the release, I thought it looked pretty good because the headline rate of inflation was only a tenth of one percent for the month, which brought the rolling one-year rate down to 7.8 percent. While 7.8 percent is still far too high, it’s down from 8.5 percent in June and 8.1 percent in July.

The chart below shows the month-to-month rate, and you can see that the June print was the worse, and July and August were much better, bringing the trend lower.

Markets were clearly unhappy, though, and it didn’t take much digging to figure out the problem.

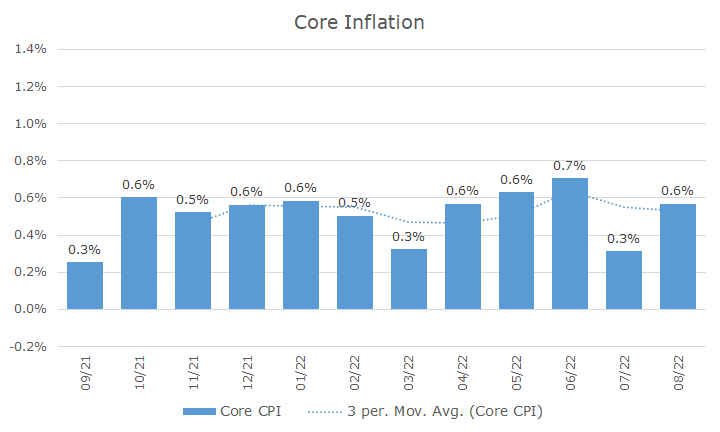

Core inflation, which excludes volatile food and energy prices, was much higher than expected at 0.6 percent for the month. The chart below shows that the trend is modestly lower for core inflation, but not by much.

In fact, only energy prices were lower. Food prices, the other item excluded from the core besides energy, rose by 0.8 percent, more than the core, which tells you that the entirety of the good headline news was nothing more than a drop in energy prices.

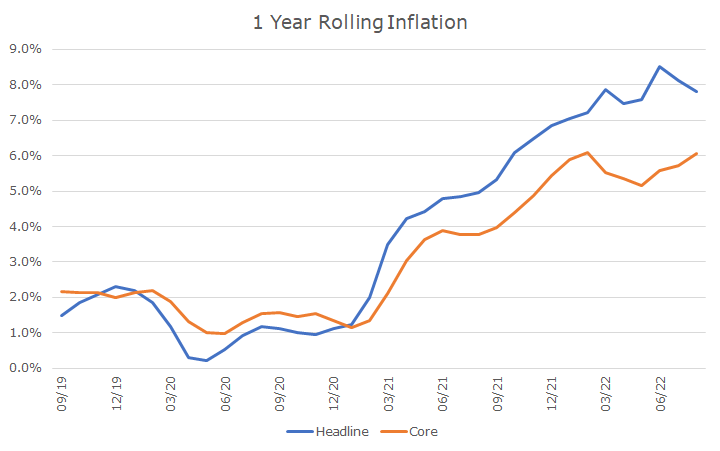

I have one more chart to illustrate the point, which shows the one-year inflation rate each month for the past three years. You can see the recent decline in the headline rate and get the idea that the overall trend is toward moderating.

However, the core rate is rising in recent months to the point where it doesn’t look any different than it did in the first few months of the year.

And that’s what has the Federal Reserve worried. Yes, we all care about food and energy prices, but we should all also recognize that they are volatile.

But if the core rate isn’t moderating in the face of higher interest rates, it means that the Fed might have to do more than everyone expects.

One interesting market response to the data came from the Treasury market. The yield on the two-year note jumped from 3.58 to 3.75 percent, which is a giant change for such a short-term bond but makes sense because it signals the market expectation of a big jump in rates from the Fed.

However, the yield on the 10-year rose a little, from 3.45 to 3.53 percent. That’s not a tiny change, but it’s not massive, either. The yield on the 10-year changed more earlier this month on lesser data.

That lack of change on the 10-year signals to me that the bond market thinks that the Fed will get inflation under control in the next decade, which is a nice feeling after a tough data point for the month.