When the Federal Reserve raised interest rates last week, they also published their Summary of Economic Projections, which you can find here.

You won’t find the word ‘recession’ in the document, but there is a pretty strong signal that the Fed thinks a recession is on the horizon in 2022.

The second page includes a nice table that shows what the Federal Reserve Board members and presidents estimate for economic growth, unemployment, inflation (core and headline), and the Fed Funds rate.

For each variable, they show the median estimate, the central tendency of the estimates, and the full range of the estimates. It also shows the changes from the last publication, which was in June.

The gross domestic product (GDP) numbers are mostly positive, although the range does show that the lowest estimate is for -0.3 percent in 2023, which would signal no recession if you use the old rule of thumb of two-quarters of economic contraction (which isn’t the real rule).

The more informative data, in my opinion, is that the median unemployment estimate for 2023 is 4.4 percent, which is 0.7 percentage points higher than the current rate of 3.7 percent.

The central tendency, which removes the three highest and three lowest estimates from the range, is 4.1 – 4.5 percent, which signals an increase of 0.4 to 0.8 percentage points.

Why does that signal a recession? Because of something called the Sahm Rule.

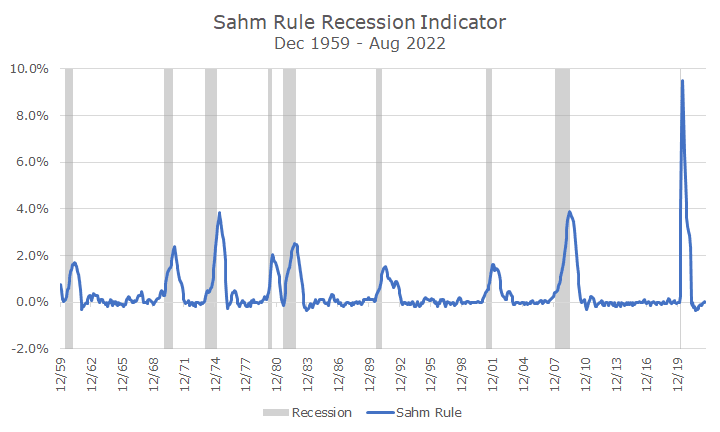

The Sahm Rule is an indicator developed by economist Claudia Sahm that estimates when the economy has entered a recession by looking at the unemployment rate.

The indicator signals a recession when the three-month moving average of the unemployment rate rises by half of a percent or more relative to its low during the previous 12 months.

The low reading for the Sahm rule is 3.5 percent, so any of the rates estimated by the Fed members would be more than half of a percent.

Here’s what the Sahm rule has looked like over time, using data from the St. Louis Federal Reserve.

It’s pretty clear that Sahm Rule pops up during recessions, and, perhaps not surprisingly, it doesn’t give any advance warning.

It’s useful to remember that the recessions that are highlighted in gray are officially made known to us by the National Bureau of Economic Research (NBER) well after a recession is over.

So, this rule might be useful for telling us that we’re in a recession (or out of one) by the time we hear it from the NBER, but the market has probably already told us by then anyway.

So, we don’t have a secret economic indicator to tell us when to get in and out of the market – big surprise.

But you can also see why the market didn’t like the news from the Fed meeting last week, just by knowing the Sahm Rule.

Next week, I’ll try and look at data for markets heading into recessions, in recessions, and, just as importantly, coming out of recessions. It’s not a fun process, but we’ve been through it before and have plenty of data to remind us why we stick to the plan even in hard times.