After Andrea Leadsom withdrew herself from consideration and cleared the way for Theresa May to replace David Cameron as Great Britain’s Prime Minister, I was interested to see how British stocks were faring there after the Brexit.

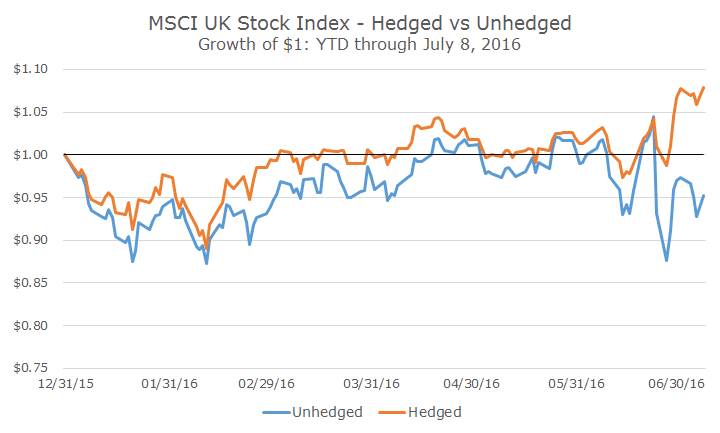

When I looked at the chart, I realized that I hadn’t been paying close enough attention because I was surprised that British stocks are actually up sharply this year – the chart shows a 7.9 percent return (in orange), but after yesterday, their stocks are up 9.39 percent in local currency terms.

It’s increasingly popular to hedge foreign currency risk when investing in stocks overseas. We’ve been using a fund that hedges currency risk for bonds for several years, because the volatility of currency swamps the bond returns. That same volatility is very small relative to stocks and we haven’t hedged the currency risk (for more details on why, click here).

But you can see the appeal because the blue line reflects what we would have experienced if we invested directly in British stocks (we have exposure to Britain through more diversified exposure). Investors like us that own dollars are down -3.22 percent for the year.

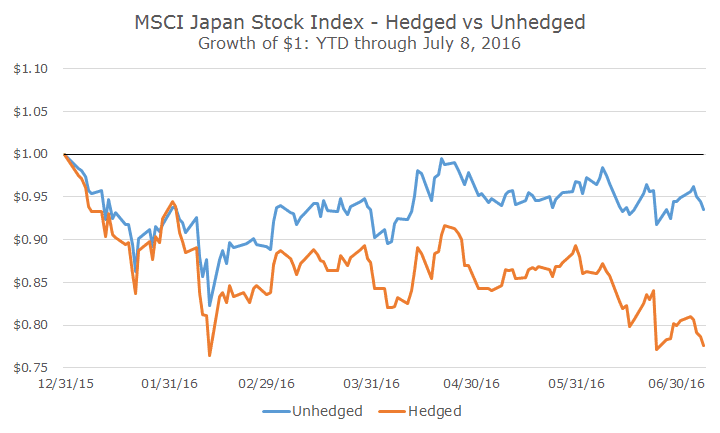

Before you email me saying that we should abandon our unhedged approach and take out the currency risk, check out how Japanese stocks have done so far this year in local currency and US dollar terms.

Unlike the British pound, which has fallen versus the US dollar, the yen has strengthened, which hurt investors who hedge. The margin of difference happens to be a lot greater so far this year, but both are short-term periods and are intended to be examples.

Ultimately, we stand by our position not to hedge for the same reasons: the expected return for holding currencies over the long run is basically zero and we don’t want to pay for the hedging – funds charge a lot more to hedge (or partially hedge).

I’ve thought about it a little more since my post last April and feel more strongly about it on the basis that having the currency risk lowers the correlation between US and non-US stocks, which lowers the volatility of the entire portfolio.

You have to believe, like we do, that the expected return for currencies is zero and be willing to hold on for a long time. That second condition is hard to live through.

We have always seen ourselves as long term investors, but sometimes it can be tough. Still, we think it’s the right thing and will keep going until we’ve convinced ourselves that there’s a better way.