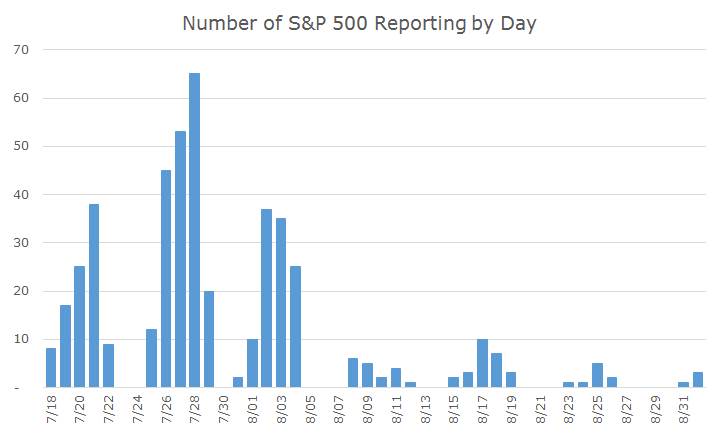

As you can see in the chart below, earnings season is upon us. While 31 companies have already reported, a full 421 companies report in the next three weeks, leaving the last 48 companies to report during the rest of August and September.

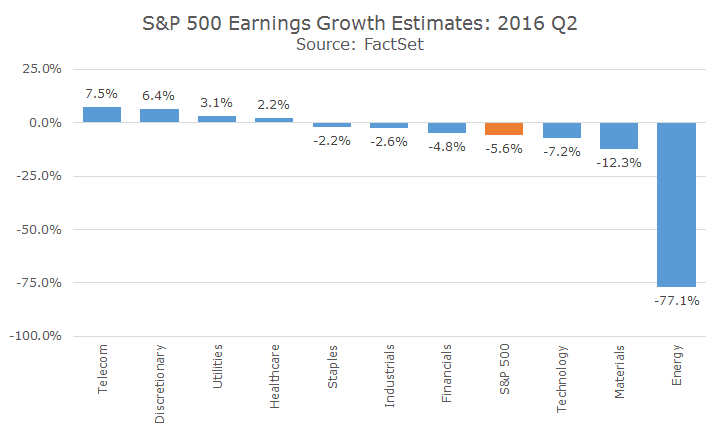

Analysts aren’t expecting much out of earnings season and think that earnings will decline by -5.6 percent.

According to FactSet, it will be the first time that the S&P 500 has recorded five consecutive quarters of year-over-year declines since the 2008 financial crisis.

As usual these days, energy stocks are the main culprit, with consensus estimates calling for a -77.1 percent decline in their earnings.

Unfortunately, though, energy isn’t the only sector to blame, with five more sectors facing losses, leaving only four sectors that are expecting actual earnings growth.

As always, the question isn’t what the markets are expecting since that is, in theory, already baked in the price. The market will be highly focused on the positive and negative surprises where analysts missed their forecasts.

I can’t help but wonder what will happen if earnings don’t offer a number of positive surprises given the recent rally. Will matching expectations allow us to keep these gains? Certainly negative surprises won’t, but are we depending on positive surprises just to stay where we are?

Of course I don’t know what the next three weeks will bring, but expect volatility during earnings season.