Markets were slightly higher on Friday despite the surprisingly weak employment situation that was well below expectations.

Bonds rallied sharply on the report with the yield on the 10-year US Treasury bond dropping almost one tenth of one percent, from 2.97 percent to 2.88 percent on Friday.

In the first few days of the year as I was reading the Wall Street outlook reports for 2014, I was struck by the economic bullishness from almost everyone. I couldn’t decide whether everyone had rose-colored glasses on or whether I was missing something obvious.

It’s not that I have a strong negative outlook – it’s just that I wasn’t sure why things seemed so rosy to so many forecasters in such a short period.

Even Nouriel Roubini, the economist known as Dr. Doom for declaring that the entire US financial system was insolvent in 2008, is saying that the US will be the big economic performer in 2014.

Friday’s disappointing jobs report may have taken some of the air out of everyone’s tires, but it is just one report, so while it should temper some enthusiasm, it’s not reason for alarm either.

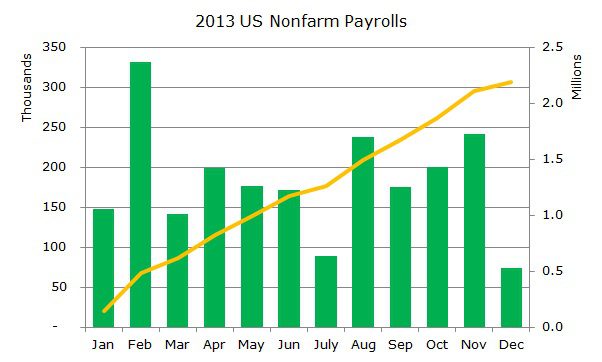

The report showed that in the month of December that only 74,000 jobs were created, well below the three-month average of 205,000 jobs and the consensus expectations of 197,000 new jobs (does that consensus expectation look suspiciously similar to the three month average to you too?).

The bar chart in green shows the monthly nonfarm jobs created on the left axis, and the yellow line shows the cumulative number of jobs created in 2013 on the right axis.

The unemployment rate fell to 6.7 percent due to the shrinking labor force. In December, 347,000 people exited the labor force, bringing the participation rate down to 62.8 percent. For reference, the participation rate was 63.5 percent six months ago in June when the unemployment rate was 7.5 percent.

Winter weather explains some of the weakness, as 273,000 people did not work due to the severe weather conditions, which was the highest number for a December reading in decades.

Still, the weather doesn’t explain the entire reading since the weakness was across the board.

At this point, one report doesn’t say much about where the jobs market is going – look back at the July reading and you will see that only 89,000 new jobs were created. Also, I suspect that the numbers will be revised upwards next month when we get the January numbers and it won’t look as bad as it does now.

In the mean time, the big story is unchanged: this continues to be a weak recovery, especially in the employment situation.

That may mean that even as the Federal Reserve pares back it’s quantitative easing program, that yields are likely to remain low for some time (read years) as the economy nurses itself back to health.