Bloomberg News reported yesterday that the private equity giant KKR was closing down a hedge fund that they formed three years ago. KKR is one of the largest and most successful private equity firms in the world, but they have struggled to find their way in other areas of the asset management business.

The hedge fund, known as KKR Equity Strategies, wasn’t successful attracting assets with only 20 clients investing $337 million after 2.5 years. That’s a little surprising because KKR had hired a star Goldman Sachs trader to run the fund after Goldman announced that it was closing its proprietary trading unit to comply with new regulations.

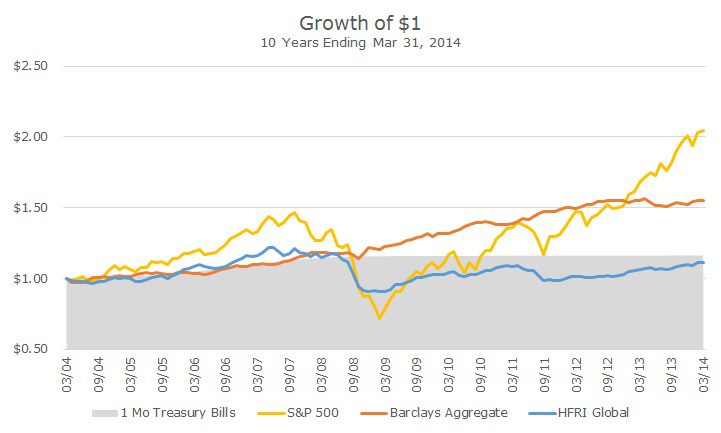

Part of the problem is that hedge funds have really struggled in recent years. In fact, that’s an understatement: an investment in one-month Treasury bills over the past ten years decidedly beat hedge funds.

One dollar invested in hedge funds, as measured by the HFRI Global Hedge Fund index, would have turned into $1.12, while $1 held in cash (bills) would have grown to $1.16. Both strategies failed to keep pace with inflation, which grew at 2.35 percent.

Hedge funds were very popular before the 2008 financial crisis. As a group, they fared well during the tech wreck and investors were eager to park their cash in hedge funds since they seemed to offer attractive returns, relatively low volatility and low correlation to either stocks or bonds. Who wouldn’t want that!?!

For reasons that are unclear, though, hedge funds haven’t delivered. Hedge funds argue that the conditions have been bad for their strategies with choppy markets, central bank intervention or other impossible to gauge excuses.

Academics argue that we finally have good data – the early information about hedge fund returns were incomplete with bad managers not reporting their results, leading to what they call survivorship bias (there are other related data problems as well).

Now that we have better data, academics say that hedge fund results look just how you would expect them to: poor because of the high expenses.

As you might expect, I tend to side with the academics. After all, hedge funds can only invest in the same things that we can: stocks, bonds and all of the hybrids in between. Hedge funds can use more techniques like short-selling, leverage, derivatives and they can be heavily concentrated.

None of these methods seem to have benefitted hedge fund investors over the last decade and the question remains: are the strategies simply out of favor or are they broken? It’s impossible to know.

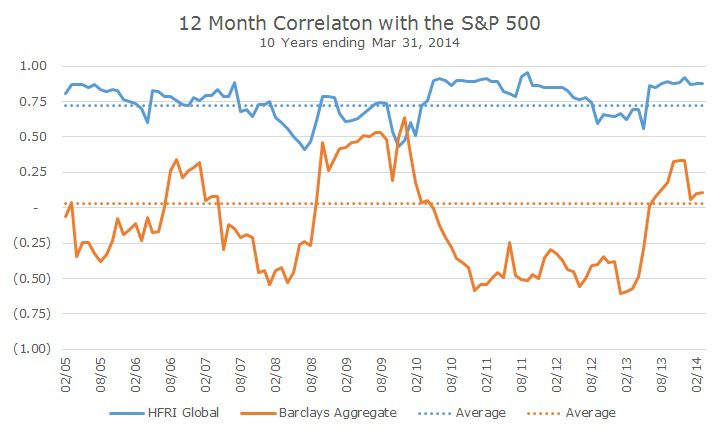

In addition to the performance problem, there is another issue worth noting: hedge funds don’t seem to hedge anymore. The following chart shows the correlation between the HFRI Global index of hedge funds versus the S&P 500 over the last year – by every 12 month period. On average, the correlation is 0.70.

Compare that to the correlation between the S&P 500 and the Barclays Aggregate bond index, where the average correlation is 0.03 – basically zero. You can see that in 2008, the correlation was higher than normal, because the credit component of the Aggregate is somewhat correlated to bonds. But even the highest correlation between stocks and bonds roughly matches the lowest correlation between hedge funds and bonds.

It would be one thing if hedge funds truly diversified your portfolio, but I found that over the last decade, including the HFRI Global index as a proxy for hedge funds never made sense. If you picked the right funds or had a longer data set, maybe you’d have something, but for now, we’re going to continue avoiding hedge funds.