In the market summary above, I referenced the fact that the yield on the ten-year Treasury note is back above the yield on the two-year Treasury note.

There was a relatively brief period where that wasn’t true, and a lot of consternation in the media and among investors that the inverted yield curve (when the shorter-term yield is higher than the longer-term yield) meant a recession was coming.

In my opinion, to really signal a recession, the curve needs to invert at the shorter end, and it has to invert for a while. The trouble is that there aren’t enough recessions to really have enough data points. And, we’re now all watching the curve as a signal of recession, which may alter the quality of the signal.

Regardless of what the curve may or may not be saying, economists are ratcheting down their economic growth estimates and signaling that the risk of recession is getting higher.

That makes sense. The Federal Reserve is hiking interest rates to curve inflation because the economy is hot. The jobless rate is very low and growth after the pandemic was booming as the economy restarted.

The balance that the Fed has to maintain is raising rates enough to curb inflation but not so much as to send the economy into recession.

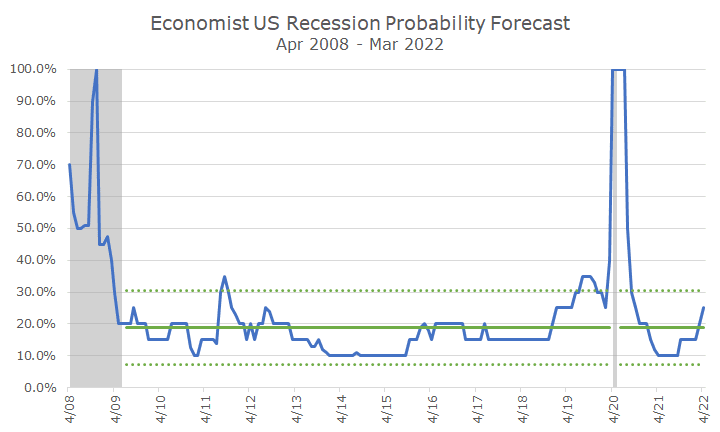

The data for the chart below is courtesy of Bloomberg, and it shows the median probability estimate from 80 economists that the US will enter a recession in the next 12 months.

Some of those economists surveyed say that there is a one percent chance of recession, and others say 80 percent. Watching the median over time is probably more useful than any of the estimates.

The chart shows that economists think that the risk of a recession is higher. The median estimate had been 10 percent and is now 25 percent.

I always shaded the actual recessions in gray and the median estimate in blue.

But also notice that I’ve got some green lines in there too. The solid green line shows the average non-recession reading, which is about 19 percent, meaning that about a fifth of economists always think a recession is coming in the next 12 months.

The dotted green lines represent one standard deviation around that average, which is about ten percentage points, which means there is a lot of noise around that average. Really, at any given time outside of a recession, 10-30 percent of economists think that a recession is coming.

And the only time that the estimates get very far outside of that range is in the actual recessions. In the recession around the 2008 financial crisis, economists did seem to get it right that the odds of being in a recession were dropping, which is a good sign.

They also got the recession around covid right, but I also think that one was pretty hard to miss. I think most high school kids saw that one coming.

But even in the two times when the median fell outside of the average range, a recession didn’t emerge (I don’t think 2020 counts because that was about covid, not whatever the economists were looking at).

So, what does it tell us that economists think a recession is coming? Not much more than what stock prices are telling us, in my opinion. Stocks are down precisely because investors are worried that the Fed will choke off growth in the process of reigning in inflation.

I like looking at the economist’s estimates, but they would be a lot more useful if they could tell me *before* the stock market did. I’ll bet those economists wish that too.

Just like the inverted yield curve, we don’t have enough data to conclude anything meaningful about the median economist probability of recession forecast.

So, the next time you hear a media personality breathlessly explain that economists see the risk of recession rising, ask yourself what they are really telling you. I’ll bet the headline, ‘Economists See 75 Percent Probability of No Recession’ in 12 months just doesn’t see as many ads.