Yesterday, the Commerce Department announced that the economy contracted by -4.8 percent in the first three months of 2020, the worst reading since the last quarter of 2008.

Analysts expect that next quarter, GDP will drop by more than 30 percent, the worst in our lifetimes.

Stocks surged. Surprised?

One of the phrases that you see me write all the time is ‘better than expectations,’ or ‘worse than consensus.’

Investors continually estimate economic data points and company fundamentals like revenue, earnings and profit margins.

Because many of those estimates are well known, prices reflect those expectations. That’s why when the actual data comes in, it’s often a ho-hum event because everybody ‘knew’ what was going to happen.

The old-timers have a phrase for it, ‘sell the rumor, buy the fact.’ When the whisper numbers start to come out, that’s when you need to do something, not when the data is released.

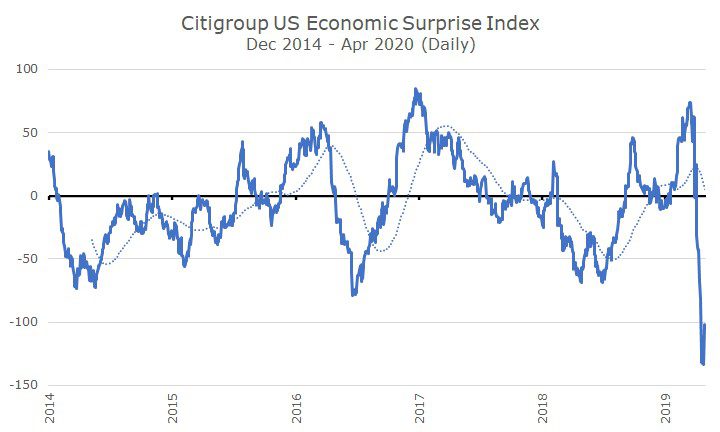

A number of years ago, Citigroup came up with a clever way to think about this with their ‘Surprise’ indexes.

For these indexes, Citigroup measures the actual results for economic data points compared to the expectations to see the differences and magnitude of those differences.

Like a lot the other indicators that I keep an eye on, I couldn’t find a way to trade this one, which makes sense because if someone could, Citigroup wouldn’t have made the indexes public.

But even if you can’t use the indexes to time the market, you can use them to say something like,’ the economy is doing better than expectations right now,’ or the ‘data is coming in worse than people thought it would,’ and that’s useful to know. I also think that the general better or worse trend is interesting.

Of course, right now, the big news is that the data is coming in worse than expected, but I suspect that’s because the indexes use all of the forecasts including the pre-revision estimates, which makes the overall number a little stale.

The interesting thing from here will be how well analysts are baking in the impact of the economic shutdown compared to what actually happens.

Right now, the market is pricing in a lot of good news, so let’s hope that the surprises are to the upside and that indicator gets back to zero in a hurry.