Halloween turned out much more treat and much less trick this year, as it ushered in an early Santa Claus rally. Since October 27th, the S&P 500 is up 14.6 percent, which is more than we hope for in a good year.

For the year, the S&P 500 is up almost 25 percent. We’ve still got a few more weeks, so it’s too early to start counting your chickens, but the big point is that stocks have been good lately.

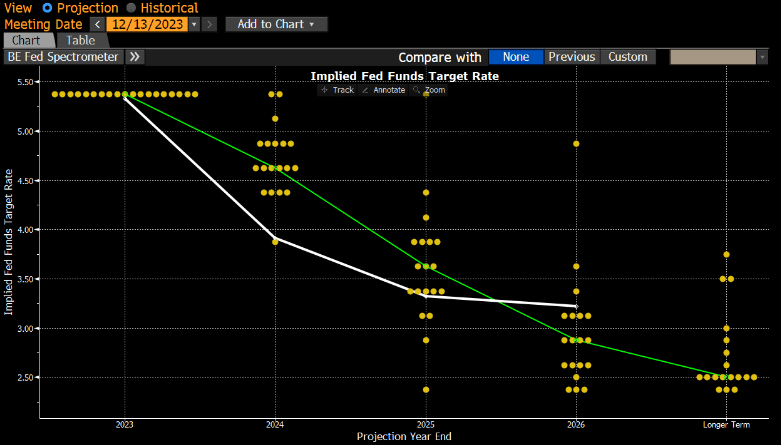

The news that excited markets this week is the ‘dot plot,’ which shows what all of the Fed governors believe will happen to interest rates in the short and medium run.

Each dot represents the view of a governor, and you can see, for example, that for 2023, all of the governors think rates will stay as they are – no surprise since 2023 is basically over.

The next column shows what they expect in 2024, and you can see some dispersion in views: one thinks rates will fall to 3.875 percent, two think they will be the same as they are now, but the median forecast calls for about 4.625 percent.

There’s more uncertainty as forecasts go farther into the future, so it makes sense that the dispersion gets even wider in 2025. The median forecast is about 3.375 percent, and the range is from 2.875 percent to 3.625 percent.

The same effect occurs for 2026 forecasts (with one call for a rate hike), and then you can see the ‘longer-term’ forecast on the far right. That’s the so-called ‘equilibrium rate’ where the Fed governors expect rates to settle. They think rates will fall to 2.5 percent over the nebulously titled ‘longer-term.’

The green line represents the median Fed governor view, and the white line looks at current prices in the futures markets to see what investors think. You can see here that the market believes that rates will fall faster than the Fed does, although it’s a radical difference, especially for 2026.

Rightly or wrongly, ‘everyone’ is now expecting lower rates, and that’s enough to make everyone jolly. My personal opinion is that rates have peaked, but markets are a little too excited about it. But know knows? Pass the eggnog.

This is the last Insights for the year – thank you for reading, and have a very Happy Holiday season and a Happy New Year!