Last week, I showed four charts that all said the same thing: US stocks are a little expensive when compared to fundamentals (click here to read the article).

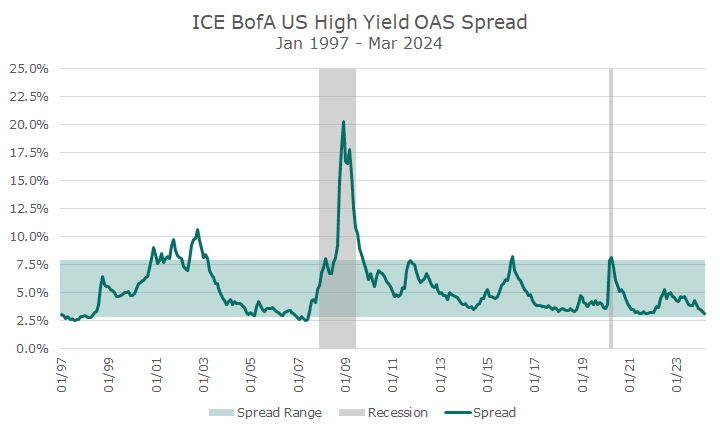

You could fairly accuse me of saying the same thing this week, but this time, I’m using the bond market. The chart below shows the spread (or difference) between high-yield bonds.

High-yield bonds, also known as junk bonds, are issued by companies that aren’t fundamentally strong and, therefore, have low credit ratings. They aren’t considered ‘investment grade,’ and many investors are prohibited from using them.

By and large, we don’t invest in them either, preferring to avoid this risk on the safer side of the portfolio.

When the spread is very high, like it was in 2008, for example, it means that investors demand a lot of return in order to take the risks associated with junk bonds. And, in 2008, when the economy was falling apart, investors were right to demand huge yields.

Thank goodness, most of the time isn’t much like 2008! That was a bit of an anomaly. So, I tried to show a ‘normal’ range for this spread, which is, in round numbers, between 2.5 and 7.5 percent. The average is about 5.4 percent.

The chart shows that we’re pretty near the bottom of that range, around 3.2 percent at the end of last month. For reference, that’s in the 90th percentile since the inception of this data in 1997.

A year ago, when everyone was worried about a recession, the spread was 4.5 percent, which is in the 50th percentile (the median is 4.7 percent, for you math geeks wondering how the 50th percentile could be so far from the average).

What is that telling you? Investors don’t see much risk right now, and they are willing to pay relatively high prices for junk bonds, which means relatively low spreads.

How is that connected to the stock market? Junk bonds and stocks are relatively highly correlated, which is partly why we don’t invest in them. Stocks and junk bonds face many of the same risks from the economy that Treasury bonds don’t face (they have other risks, though).

To paraphrase Warren Buffet, investors appear greedy in the aggregate, which means that we should be cautious (he says fearful, but I think that’s an overstatement – you shouldn’t be fearful if you have an appropriate stock/bond allocation and are diversified in other ways).

Next week, I promise to cover new ground instead of showing you a different spin on the same story!