Well, today’s the day that we will in all likelihood get news that after seven years, interest rates will come off of the floor. The Zero Interest Rate Policy (ZIRP) that the Fed has engaged in will finally be over.

Although I have the feeling that what the Fed will do next will still dominate the conversation (when will they raise again, by how much, etc.), it will be nice to see interest rates above zero. It felt like the quantitative easing program would never end, but it did (well, they stopped buying more bonds anyway) and now interest rates will be something instead of nothing, which is a plus.

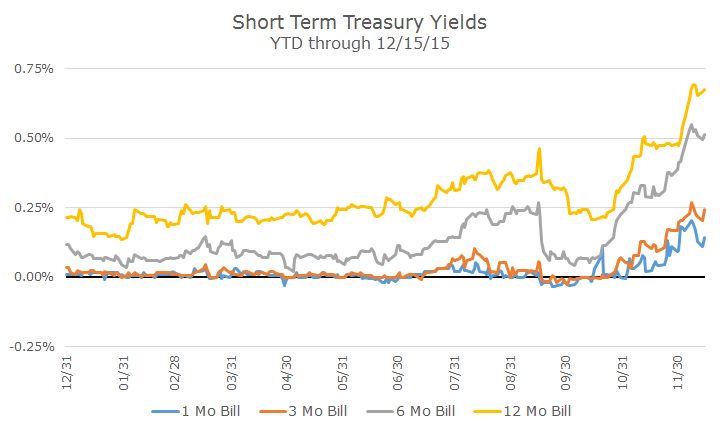

It’s natural to be concerned about how the market will respond to the new policy, but I do take comfort that markets are responding well thus far. The chart below shows the yields for several short-term Treasury bills (1, 3, 6 and 12-months) and you can see that they are higher in anticipation of the Fed move.

It’s interesting to see how yields were ticking up in advance of the September meeting, but fell sharply when the Fed failed to raise rates. It wasn’t long, though, thanks to plenty of Fed jawboning, before it became clear that December was the new ‘go’ day.

The very short-term bills, three and six months, are much higher today than they were before the September meeting, reflecting greater confidence that the Fed will act.

In my mind, what you see in the chart makes a lot of sense – it’s a visualization of the common phrase, that ‘markets have already priced in’ the forthcoming news about interest rates.

I’ll be shocked if they don’t act, but assuming that they do, the market reaction shouldn’t be too great because markets have already driven up the short-term rates that the Fed doesn’t control.

I am relieved to see that market rates have already moved as you would expect and I will be further relieved when the Fed acts. It’s been a long, slow and fraught process getting this far, and while it’s good to see progress, it makes sense to me to expect a very slow increase in rates from here as the long, slow and fraught process continues.

We’re passing another milestone, but the trip is far from over.