Stocks were sharply higher last week, more than erasing the prior week’s declines. Although Wednesday suffered a tough selloff of more than two percent, Thursday’s 5.6 percent rally and Friday’s 0.9 percent move higher took the S&P 500 Total Return for the week to 5.9 percent.

The big move is easily attributed to the better-than-expected Consumer Price Inflation (CPI) index, which was finally a step in the right direction (more below).

Treasury bonds also rallied with the curve steepening and the 10-year closing at 3.82 percent (although still well below the two-year Treasury, which closed at 4.32 percent).

The dollar was substantially weaker, particularly versus the yen, and suffered its worst weekly loss since the outset of the pandemic, losing -4.1 percent. This helped foreign stocks outperform the S&P 500.

Gold also had its best week in more than two and a half years, up 5.5 percent. Oil was weaker overall, with WTI crude falling -3.9 percent.

Technology stocks were the clear winner this week, up 10.0 percent, with communications and materials not far behind, gaining 9.2 and 7.7 percent, respectively. The worst performing sectors, utilities, and healthcare, still gained more than a percent, up 1.4 and 1.8 percent, respectively.

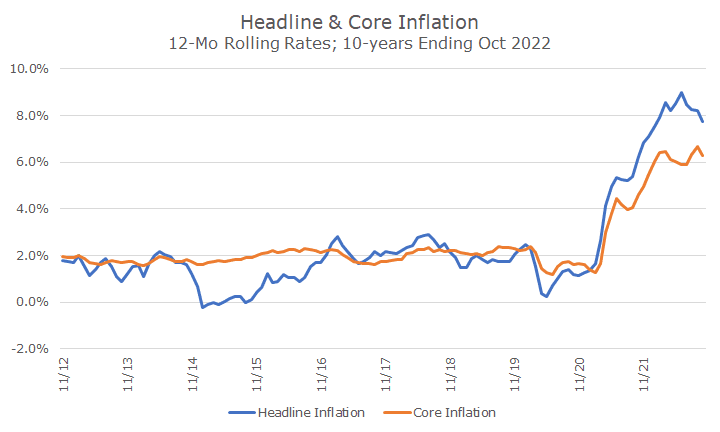

Did you ever think that markets would be so excited for an annual headline inflation rate of 7.8 percent? Or a core inflation rate of 6.3 percent?

I guess 7.8 percent does feel a whole lot better than the 9.0 percent rate back in June, but that was only one reading. And I think that’s the point, it’s great to have one positive data point, which we did, but it’s also just one data point.

To spin it a little better, the headline rate was the lowest for this year and below the eight percent handle. The core rate, which excludes food and energy, was good too, but not as good as it was from March to July (I couldn’t spin that very well).

The big takeaway from a markets perspective is that ‘peak inflation’ may be behind us, which means that the Federal Reserve may slow down the pace of interest rate hikes.

Already, markets are pricing in a half percent rate hike at the next meeting instead of the three-quarters of a percent hike we’ve endured since early summer. Nobody thinks that there won’t be any more hikes, but maybe they will be smaller and less frequent from here.

I try to cover just one thing in an Insight, but last week was very dramatic, not just because of the inflation news and the corresponding strong markets, but because one of the largest crypto exchanges collapsed.

FTX, run by former crypto-billionaire Sam Bankman-Fried, went bankrupt after encountering ‘liquidity’ problems. At this point, no one is quite sure what exactly happened, but it looks to me like an old-fashioned bank run: a highly leveraged company that invested aggressively and lost far more than its balance sheet could handle.

I’ve been a crypto-skeptic since I first wrote about it here in 2017, but I also dabbled in it with a few hundred dollars (I lost money). I’ve been curious and felt like I was missing out, but didn’t get it (and still don’t).

I don’t think that the FTX implosion is the end of blockchain technology or even crypto, but the wild west ecosystem is likely to change through more regulation.

I’ll also admit to a little feeling of schadenfreude and think that this headline from the Onion sums it up pretty well.

And as long as I’m breaking my editorial rules about the number of topics in one email, let me add another: this weekend Marie and Ched got married and a lot of Acropolitans turned up at the wedding and had a great time.

They met at Acropolis, but are just the second married couple on the team! Here’s a photo of the happy couple from our family party at Grant’s Farm last month.

I plan on including more photos of the folks at Acropolis in the future, so stay tuned for some fun!