Before the big rally last week, a client asked me whether bonds had become more volatile than stocks.

Although he was partially kidding, his point was right on: bonds have been volatile this year, especially in recent weeks. And the rally last week still adds to volatility, it’s just easier to stomach when prices are rising.

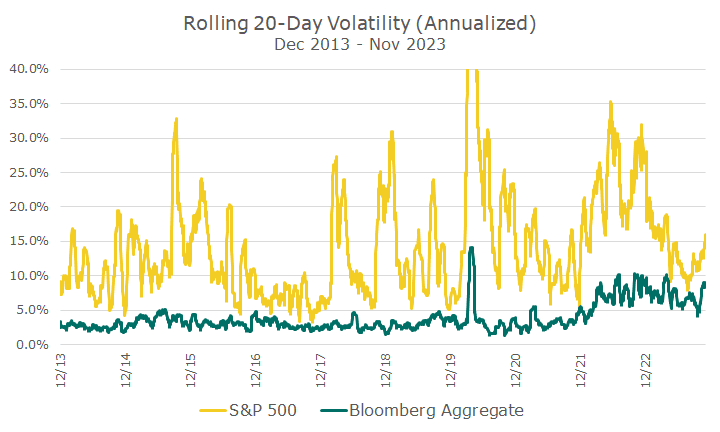

To illustrate the rise on bond volatility, I calculate the 20-day rolling volatility of the Bloomberg Aggregate bond index. This index includes all taxable investment-grade bonds, except inflation-protected Treasury bonds (TIPs).

You can see that the green line is pretty consistent over the past decade, outside of the pandemic, when everything went haywire, and since the start of 2022, when interest rates started to shoot higher, which hurt bond prices.

It may have been cooling a little bit this year until the last week weeks, but it’s hard to tell since the data is pretty noisy.

For comparison’s sake, I did the same thing for the S&P 500, but you see a lot more volatility with stocks, which shouldn’t be much of a surprise to anyone.

Note that I clipped the chart with an annualized standard deviation of 40 percent. When the pandemic hit, volatility rose to almost 100 percent, which altered the chart so much that you couldn’t see any variation in bonds whatsoever.

I think it’s interesting to see how volatility comes and goes with stocks. At one-point last month, the volatility of stocks was almost as low as bonds, which is both a statement about how low stock volatility was and the elevated level of bond volatility.

Even still, though, the big message of the chart is that stocks were and are way more volatile than bonds. Bonds don’t offer perfect safety and have been volatile of late, but their volatility is low relative to stocks.

That said, I’m ready for bond volatility to drop to pre-2022 levels indefinitely. We’ll see.