Markets were caught off guard last week by several inflation data points last week, and the biggest surprise came from the core inflation rate which was expected to come in at 0.3 percent for the month but was 0.9 percent instead.

Most of the time stocks and bonds move independently of each other, but stock and bond prices fell on the inflation news because it could prompt the Federal Reserve to raise interest rates sooner than markets expect, which would adversely impact both assets.

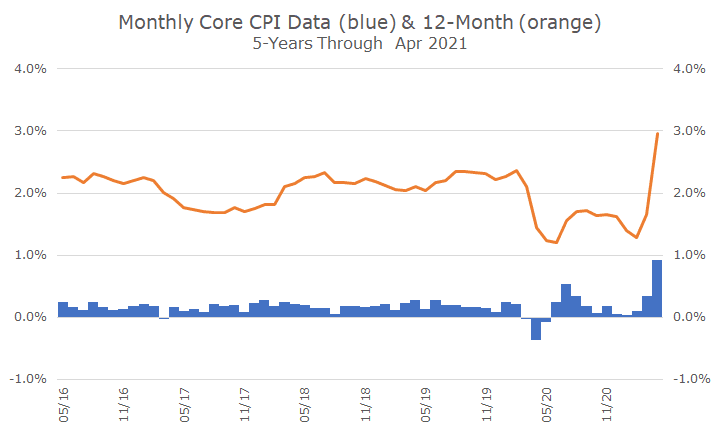

The chart below includes two pieces of related data that show just how big the inflation jump was last month. The first data is the blue columns that show the inflation rate month.

It’s a little hard to see because of the scale, but most of the time, the monthly numbers over the last five years were around 0.15 percent. Some were higher, and a few were negative when the pandemic first hit, but the last month stands out like a sore thumb because it’s almost one full percentage point.

The second data is a line chart in orange, which shows the rolling 12-month inflation rate, essentially ‘adding up’ all of the monthly numbers so that you can see how inflation was in annual terms.

Before the pandemic, you can see that the core rate, which excludes food and energy, hovered around two percent – sometimes a little higher and sometimes a little lower.

And, you can see the pandemic pretty clearly, because the deflationary months drag down the annualized run rate from over two percent to about 1.25 percent – well below the Federal Reserve target of two percent.

And you can see that last month’s jump was so strong that the 12-month inflation is now three percent.

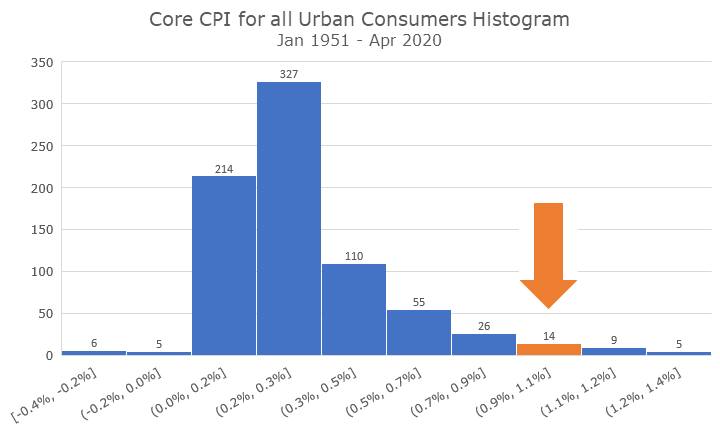

When I pulled the data to create the chart above, I was curious about how April’s inflation rate compared to the full data set, which starts in 1951.

The histogram below divides each monthly inflation data points into ten groups, and I’ve indicated where the current month falls in orange (with the big orange arrow). In all 771 months of data, this was in the 28, which puts it in the top five percent of all readings.

We first wrote about inflation in March because the bond market was signaling some concern about it, both in terms of higher interest rates and something called a ‘breakeven’ rate.

The breakeven rate looks at the difference in yield on a regular Treasury bond and inflation-protected Treasury bonds to estimate what the market thinks inflation will be. The breakeven rates fell to very low levels during the pandemic and were starting to come back in March.

At the time, we wrote that over the short run, the bond market expected inflation to run around three percent, and then fall back down to 2-2.5 percent. In that sense, the bond market got it right – we now have some short-term inflation around three percent, and at this point, markets think that inflation over the next 0 years will still be 2.5 percent.

Right now, the market agrees with the Federal Reserve that the spike in inflation is due to the economy reopening, the logistics problems related to computer chips, and other ‘transitory’ factors that will pass with time.

Obviously, it remains to be seen what will happen – the future is always impossible to predict. I’m not speaking for Acropolis, but my personal view is that inflation isn’t likely to be a long-term problem because once we get past the outburst of pent-up demand related to the pandemic receding, we’re going back to a heavily indebted economy (in fact, far more indebted economy).

The overall indebtedness, along with computerization and demographics should keep inflation largely in check in my opinion, but I’m not an economist (and they don’t know either).

Back in March, I wrote about investment strategies for an inflationary environment, and there aren’t a lot of great options. A lot depends on the speed and magnitude of the inflation, which is also hard to predict.

Our financial planning model assumes that inflation runs at three percent, and we’re just getting there for the first time in more than a decade. We also run stress tests with the model to assume four percent (or more) in the coming decades, and we’re pretty far from that so far.

So, for now it’s important to realize that inflation is something to watch with a keen eye, but that’s about it for now. There is a lot of noise in all data, and we need to see more before doing anything differently.