Some of the hottest exchange-traded funds (ETFs) over the past few years come from the ARK family of funds, founded and run by famed investor Cathy Woods.

The ARK funds are a series of theme-based ETFs that seek to find the early companies in a variety of emerging fields including robotics, space exploration, genomics, fintech, and 3D printing, among others.

I can’t say that I’m very familiar with the ARK funds outside of the volumes of Wall Street Journal articles, so I’ll focus on the ARK Innovation fund (ticker symbol: ARKK), which I assume broadly captures many of the narrower themes.

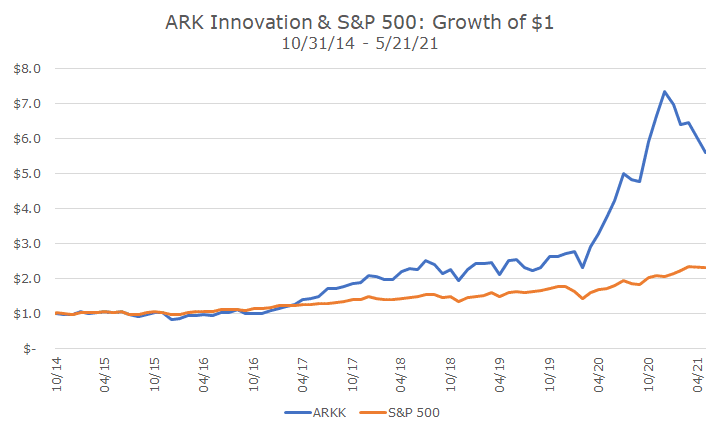

Until this month, the funds have been extraordinarily hot, both in performance and inflows (which are often highly correlated factors). The chart below shows why – the S&P 500 looks like it is flatlining compared to ARKK, even though the S&P 500 more than doubled in this period.

Obviously, the last few months have been tough for ARKK and just as there were a lot of stories about Woods’ Midas touch, the articles now wonder aloud whether her 15 minutes of fame is now over.

I don’t have an opinion about Woods or ARK, other than envy and admiration for the success that she’s had over the past few years (and probably before that, but I just don’t know much about her).

My point in this article is that the recent bad performance was eminently predictable – and maybe just fine. After all, despite the rough sell-off of late, the fund is still legions ahead of the S&P 500 (except for investors that just bought in).

Here are at least three ways that anyone could have seen this coming. First, the annualized volatility of the funds is 30 percent – about double that of the S&P 500 since the inception of the ARKK ETF. The average return is also 30 percent per annum, so it’s done very well on a risk-adjusted basis, it’s just a lot of risk.

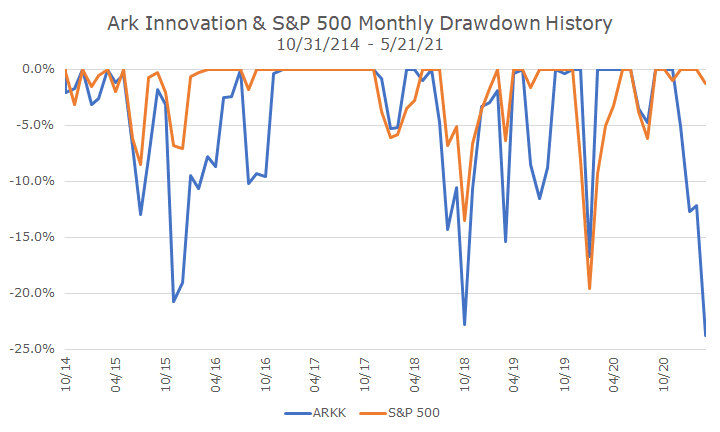

Second, the drawdown history of the fund tells you that this has happened before, multiple times, as seen in the chart below.

This appears to be the third time that the fund has declined by more than 20 percent in its six-year life. The first one was in 2016 and the market was down some, but not nearly as much. Then there was the quick fall at the end of 2018 when stocks sold off but quickly recovered.

This drawdown is different because the S&P 500 isn’t selling off at all compared to the ARK funds, so investors must be questioning whether there is something unique to these strategies or whether a macro factor like inflation will affect the strategies differently than the overall market.

The third measure that could have foretold such a dramatic difference is a technical item called ‘tracking error’ that looks at the volatility of difference in return from the market.

In this case, the tracking error is 20 percent, which means that you would expect the ARK fund to be 20 percentage points different than the market six out of every ten years, and more than 40 percentage points more or less in one out of every 20 years!

We’ve seen a few years of positive tracking error, and since trees don’t grow to the sky, investors should expect some bad ones too.

We wouldn’t invest in the ARKK fund for all of those reasons, preferring tighter risk management. And, we didn’t experience the big benefit that ARK investors enjoyed up until a few months ago.

But here’s the other reason that we wouldn’t invest in them, and it has nothing to do with the risk measures: valuation.

A simple look at the price-earnings ratio makes you scratch your head at -94.0. You might think the S&P 500 is expensive at 33.3, but -94.0 means that earnings are negative. If you exclude the companies that are losing money, the PE ratio on ARK is 62.9, compared to 28.4 for the S&P 500.

That’s right, a full 60.8 percent of the companies in ARK are losing money. That makes some sense because many of these companies are at the cutting edge on the business front and haven’t figured out how to make money yet.

It’s hard for us to want to invest in something so risky, where most of the companies lose money and you still have to pay nosebleed prices. As I’ve noted, these characteristics have been good for ARK customers until recently, but I don’t think I could look someone in the eye during a drawdown like this and say, ‘over the long run, this should work out…’

It’s just hard to know what the long-run is for these companies. Sure, I believe in a future that includes robotics and space exploration, but there’s an old saying that there’s no such thing as a bad investment, only a bad price.

A lot of the companies that blew up in the tech bubble were perfectly good ideas that have turned into good businesses in the decades since then. But the investors at that time, who were right that the internet would change everything still lost a pile of money.