In my judgment, the biggest stories of 2014 were falling interest rates and oil prices. I’ve written that most people expected interest rates to rise and no one expected a major drop in oil prices.

The combination of those two things, plus the unexpected rise in the U.S. dollar (a big story, but not as big as the first two) means that inflation expectations have fallen dramatically in the U.S.

Back in October, I wrote that you can see what the bond market thinks inflation will be by comparing the yield on regular (or, nominal) Treasury bonds compared to inflation protected bonds, called TIPs. If you would like a refresher course, click here.

Since I wrote the article, inflation expectations have fallen dramatically in the US. In the middle of last year, the bond market thought that inflation would average two percent per year for the next five years. Today, they think inflation will be closer to 1.2 percent per year, which is a big difference.

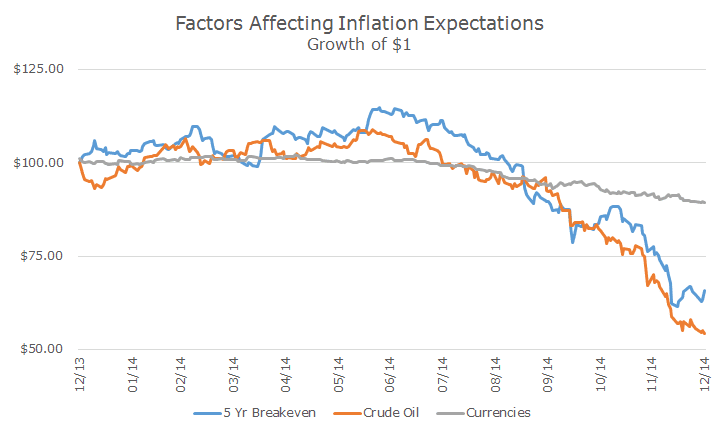

The drop in inflation expectations is very much related to the fall in oil prices and the dollar, which the chart below shows. The relationship isn’t perfect, but it’s hard to miss the trend visually.

Perhaps I should amend my list of top stories to start with falling oil prices, which led to lower inflation expectations that resulted in lower interest rates.

That’s a great story, but it leaves out the fact that interest rates were falling before inflation expectations declined so much. Still though, it’s fair to say that all of these issues are highly intertwined, even if they can’t be obviously disentangled.

Lower inflation expectations mean that the Federal Reserve could keep interest rates lower for longer. Futures markets clearly suggest that hikes will begin this year, but there does seem to be a small whisper campaign saying that it may be too soon and we could be surprised by the Fed’s inaction this year.

Who knows, stay tuned…