What’s the right allocation to a risky asset class like emerging markets stocks?

Since the launch of the MSCI EAFE EM index that tracks emerging markets in 1988, the returns have outpaced the S&P 500 by 0.33 percent per year: 10.56 percent versus 10.23 percent. (All data from Jan 1988 through Jun 2016).

As you might expect, the extra return has come with extra risk: the emerging markets index has been 60 percent more volatile than the S&P 500. This can’t be news to anyone, especially after the last five years, where the MSCI EAFE EM index has fallen a cumulative -16.06 percent per year while the S&P 500 has earned a cumulative return of 77.02 percent.

Most people reading those numbers will think, ‘why do we own this stuff?’ Well, if you want to buy low and sell high, you should want to sell your US stocks and buy emerging markets (Blackrock, the largest asset manager in the world, said that emerging markets stocks are now an ‘overweight’ just yesterday).

What’s the right allocation given the risk and recent returns? That’s a tough one. A pure market theorist (which I am not), would say that you should own the natural market weight of emerging markets, which is 10.57 percent of an equity portfolio. US stocks should be 53.04 percent and other developed market stocks ought to be 36.39 percent.

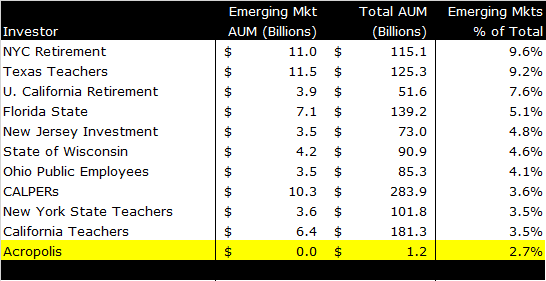

A recent article in Pensions & Investments magazine showed the allocation to emerging markets from an assortment of large pensions. Their article focused on what pensions had the largest dollars in emerging markets, which are the Texas Teachers at $11.5 billion.

I was more interested in the percentage weight of emerging markets stocks compared to the whole portfolio, which for the Texas Teachers was 9.2 percent. I thought it was interesting because presumably these pensions all have large bond allocations.

So, let’s say that Texas Teachers has a classic 60/40 stock/bond split, which would mean that 15 percent of their stock allocation is in emerging markets – quite a bit more than what the pure theorist would suggest.

Using 60/40 as a paradigm (not that it’s optimal, just common), you would say that the natural weight for emerging markets is roughly six percent, or 10 percent of the equity allocation. Well, only three of the pensions have that much (if they are 60/40’s, which they may or may not be).

And then there is little old Acropolis, which shows up as a $0.0 in emerging markets assets under management (AUM), since our paltry $29 million or so is a rounding error when measured in billions. Of our $1.2 billion, though, the allocation works out to 2.7 percent.

We’re pretty close to the 60/40 stock/bond mix, so you can see that we have about half of what a pure theorist would suggest. I like emerging markets, especially now after five years of lousy returns, but we have a ‘home bias,’ where we allocation more to the US than what a pure theorist would suggest.

We have roughly the same mix between developed and emerging markets stocks, we just have a lot less non-US stocks than the natural weight (more on home bias in the coming days).

I feel pretty small on that list, but then I realized how small all of us are (like when I look at the stars on a clear night).

According to data from Dimensional Fund Advisors (DFA), the total dollar value of emerging markets stocks is $4.3 trillion or so, which means that even the Texas Teachers and their $11.5 billion only own a quarter percent or so of the available stock.

So much for being ‘size guys.’