These are trying times for investors. We all know that markets are risky, and there are extended periods of bad times, but historically, the good times have more than offset the bad times, and the risks have been worth taking.

In an attempt to ease the pain of down markets, some investors have pursued what is commonly called low-volatility funds. Other names for similar strategies include minimum variance and minimum volatility, but the ideas are similar: an equity portfolio that is less risky than the overall market.

There are a lot of flavors of these lower-risk funds, but there is no category of them that I could find. As a result, I will look at one of the larger, more well-known funds. I didn’t look at it because it’s the best or the worst but because it has a lot of assets in the category and has a relatively long track record. I’m calling it Low Volatility Fund X.

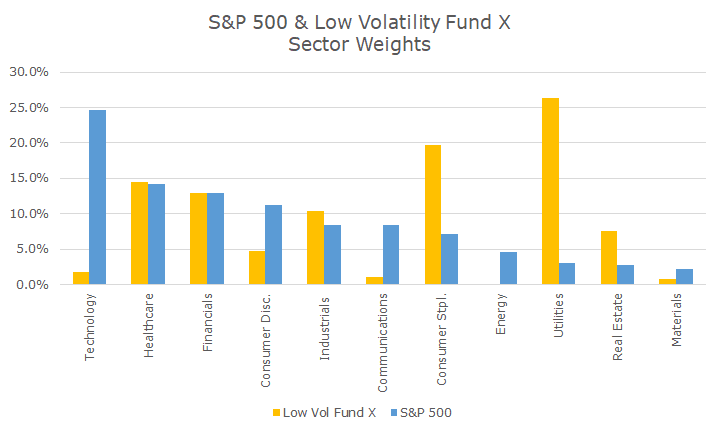

The funds work in different ways, but the basic idea is that they select stocks and weight them by their low volatility. In the case of Low Volatility Fund X, the weights are astonishingly different from the market, as seen in the chart below.

The weights no doubt change over time, but this current snapshot is dramatic. The fund has no energy stocks and less than 10 percent of the market weight in technology stocks. That makes sense since they are so volatile, but they’re also pretty big bets.

The same is true with utilities, consumer staples, and real estate stocks, which are massively overweight compared to the market. Utilities are actually 26.3 percent of the fund, which is more than 7x the market weight and a larger position than technology is to the S&P 500.

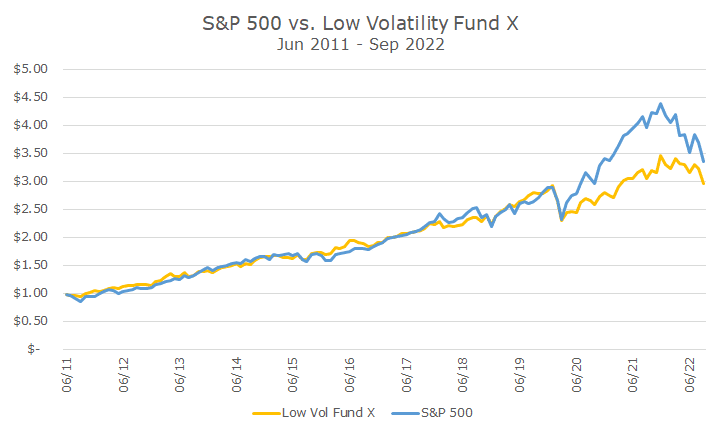

This all makes sense, but again, the bets are so big that investors in this fund should expect pretty different results than the overall market. In fact, the results are different, but maybe not as much as you might expect, based on the chart below.

You can see above that, until the pandemic, the results of the Low Volatility Fund X and S&P 500 were pretty similar. In fact, the fund earned 9.9 percent, and the S&P 500 earned 10 percent until Feb 2022. Impressively, it did that with about 16 percent less volatility, which is what you want in a low-volatility fund.

When the government stimulus for the pandemic came out, and the market got hot (especially stocks like Teledoc, Pelaton, Zoom, and other -stay-at-home stocks), the low volatility fund didn’t fare as well. But, true to its promise, it was also about 24 percent less volatile than the overall market.

In the current market, the low-volatility fund has done better, falling -14.4 percent this year through September, while the S&P 500 lost -23.9 percent over the same period.

So, why don’t we own low-volatility funds?

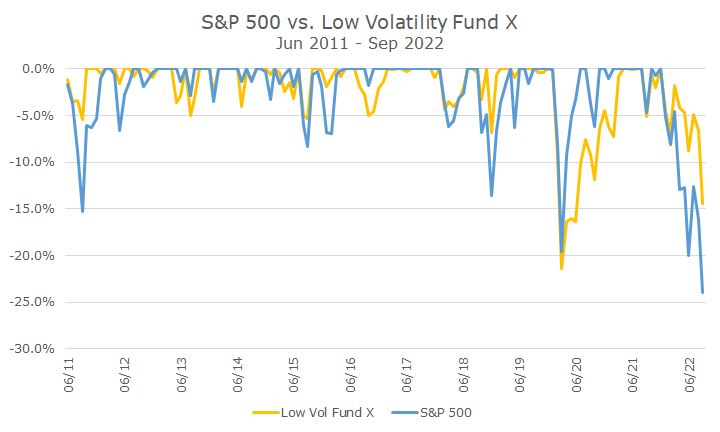

For a few reasons. First, we don’t think they work the way people think. People think that they will lose less than the market with a low-volatility fund, and while that’s true this year, that isn’t always true.

The chart below shows that Low Volatility Fund X lost more than the market in the pandemic, at least using monthly data. It lost more a few other times, too, although the magnitude each time was relatively small.

But people who think they are ‘safe’ with a low volatility fund might not stick with it if they’re down -20 percent or more when the market isn’t down that much.

Second, we expect low-volatility funds to underperform the market over the long run. This fund has been around for a little more than 11 years and underperformed the market by more than a percentage point per year during that time.

Granted, we are in a bear market now, which is when these funds shine, so this fund may look better than the market in another few months if the market keeps dropping. But, when the market reverses, this won’t fare as well on the upside.

Philosophically, we think that risk and return go hand-in-hand, so a fund that earns as much or more than the market with less risk is a bit of a free lunch that doesn’t make a lot of sense.

If these funds lost less in drawdowns, that would be one thing, but that isn’t their main claim. Their main claim is that they have less volatility than the overall market. For this fund, that’s been true: the volatility was almost 20 percent less than the market over the fund’s life.

That’s pretty good, but we think it’s hard for investors to tell the difference between that and the overall market if they don’t fall less than the market by 20 percent. This one is during this drawdown, but that’s not always the case.

In the long run, we think it’s better to accept the market risk or even take on a little more to try and earn a higher return and lower the overall portfolio risk some other way.

We’ve been using bonds for this purpose for about 20 years, and while it’s not working well this year, it’s philosophically more sensible and produced similar results to the low-volatility fund.

The low volatility fund eked out a slightly higher risk-adjusted return, but it was less than 10 percent better than a mix of stocks/bonds of around 85/15 percent. That margin is too small to really matter – it’s a bit like going 66 on the highway instead of 60; you can tell with the instruments, but not when you’re a passenger in the back seat.

I’m not exactly opposed to low-volatility funds, but while the appeal is high right now, conditions will change, and I’m not sure people will stick with them. Still, they are interesting, and worth continued study.

Before I sign off, here is the link I promised last week for our hot-off-the-presses quarterly newsletter, Portfolio Insights.