One of the interesting implications of the recent selloff in stocks and rally in bonds is that investors have quickly shifted gears regarding when they think that the Federal Reserve will begin to raise interest rates.

Right now, the market expects the Fed to announce that they will end their bond-buying program, known as quantitative easing, at their meeting on October 29th.

There has been some scuttlebutt that the Fed might continue the program given recent lower global growth forecasts and falling inflation expectations, but that’s viewed as an outlier at this point.

With the bond buying program complete, the next question is when the Fed will begin to actually raise interest rates. In her first press conference as Fed Chair, Janet Yellen said in March that the Fed was likely to consider raising rates for a ‘considerable time’ after the bond buying program was complete.

The she surprised markets by defining a considerable time as something on the order of six months. At that point, it seemed likely that the program would be over in the October or December meeting, so all eyes fixated on the middle of next year for liftoff in the federal funds rate.

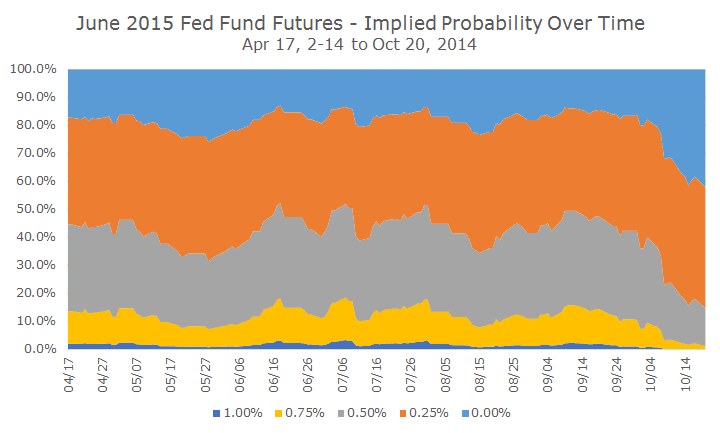

The following chart helps quantify what investors have ‘priced in’ to securities prices for the highly anticipated Fed hike.

The chart is confusing because it’s looking at what investors think about a specific point in time (June 2015) over a period of time (April through today).

Back in April, the chart shows most investors expected some increase in rates since investors put a less than 20 percent chance on rates being at zero next June, as indicated by the light blue area on the left of the chart.

The probability that short-term rates would be between 0.25 and 0.50 percent was approximately 70 percent and the probability of rates at 0.75 percent or higher was less than 15 percent.

Since prices change every day to reflect new information (economic data releases, Fed speeches, etc.), there is some noise in the data, but that basic landscape remains unchanged until October of this year.

Notice how the odds of nothing happening next June shoots up from around 15 percent at the end of the quarter three weeks ago to more than a 40 percent chance today. That’s a big move – the odds of nothing happening nearly tripled in a very short time.

While the odds of a hike to 0.25 percent are largely unchanged in recent weeks, the market now believes that the odds of fed funds going to 0.50 percent or higher is now less than 15 percent (and the odds of fed funds being at one percent collapsed to nothing.

Essentially, the bet is that the inevitable rate hike has been pushed off from the summer of next year to the fall of next year. Just a few weeks ago, there was a major debate about whether the timing should be pushed up, but the inflation hawks have lost that battle for the moment and it appears that short-term interest rates will truly be lower for longer.