The stock market has been unusually quiet this year. For example, the S&P 500 didn’t fall by more than one percent until March 21st, just before the quarter ended.

The Chicago Board of Options (CBOE) Volatility Index (VIX), which measures expected volatility, had the second lowest average reading for the quarter since the index was created in 1992.

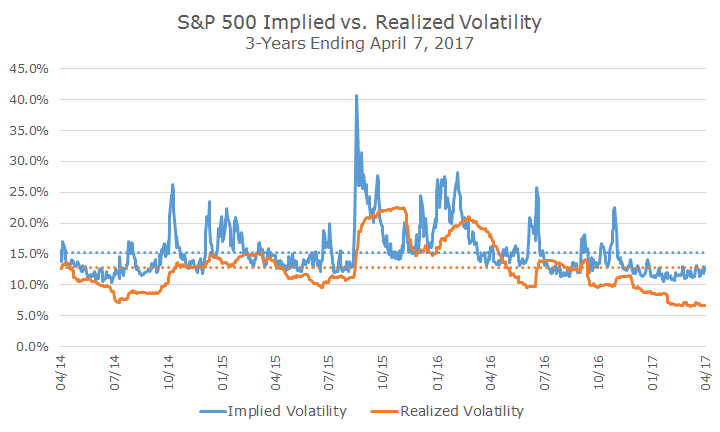

The chart below plots the VIX over the last three quarters in blue and the dotted blue line shows the average over that time frame. Over the very long run, the average reading for the index is about 18 percent, whereas the average over this period was right above 15 percent.

To some extent the long-term average is misleading because there are some major spikes that bring the average up much higher. We can see the same thing in the chart below – the reading of 40 percent at the back half of 2015 is a small example of this phenomenon.

As mentioned above, the VIX is the implied volatility based on current market expectations. Investors often expect higher volatility than what’s realized, so I also plotted the realized volatility for the S&P 500 in orange (the orange dotted line is the average realized volatility).

The volatility that we’ve experienced (or realized) since the election is unusually low. You would think that I love volatility, especially when market returns are positive, like they have been over this same time period.

I do like it, actually, but it also raises my anxiety level because I know that we aren’t in a ‘new era’ of low volatility investing. Still, the low volatility makes me a little anxious because something, somewhere, somehow, will bring it back even if I don’t know the ‘who, what, where and how’.

In the past, I’ve criticized people in my business who talk ominously about the ‘coming volatility’ because it’s often used as a tool to scare people into some kind of product. That’s not my goal today; I simply want to point out that what we’re experiencing, while nice, isn’t normal and that we don’t want to be psychologically complacent.

In the meantime, though, we can enjoy the low volatility, just as we can enjoy this lovely spring weather.