There are many interesting things going on right now and one of them, in my view, is the sharp rally in micro cap stocks in the past four trading sessions.

I’ve noted in earlier missives that small cap stocks are having a very tough year so far, especially at the end of the third quarter (just in time for your quarterly reports, I’m afraid).

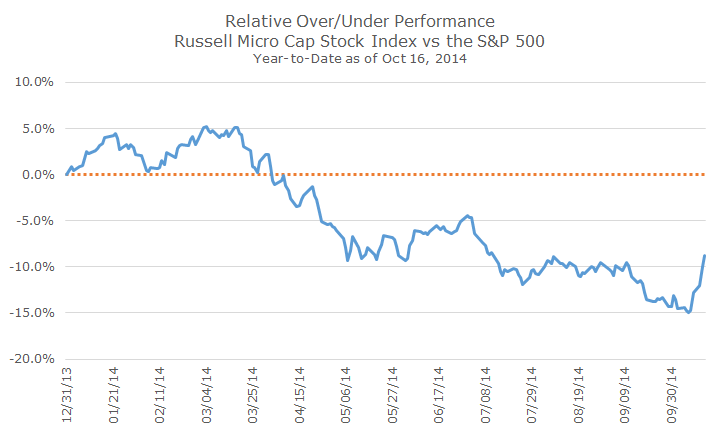

The following chart shows the relative performance of micro cap stocks (the smallest of the small) versus large cap stocks, as measured by the S&P 500.

In this graph, when the blue line is above the orange-dotted line, micro cap stocks are outperforming, which you can see through the end of the first quarter.

In the second quarter, micro caps sold off relative to large cap stocks. That trend accelerated in the third quarter and hit a fevered pitch last week when micro cap stocks where more than 15 percentage points worse off than the S&P 500.

Last week, I wanted to see how rare that was, so I looked at the monthly results for the micro cap fund that we use, which goes back to 1981, and found that the 12-months ending on September 30th fell in the 11th percentile in all of the 12-month periods since the inception of the fund.

And that was the good news. The relative performance in that bottom decile was really bad, more than 25 percentage points if memory serves me.

Actually, the good news is that micro cap stocks do outperform large cap stocks over time, but it can obviously take a while with such large swings of underperformance.

Whenever we talk about strategies that outperform, we always talk about them being riskier. I’ve shown a chart for years (that I promise to show in the future in Daily Insights) which shows that, on average, micro cap stocks outperform large cap stocks by two percent per year.

I then follow it up with a slide that shows the volatility associated with micro cap stocks and it’s about double that of the S&P 500.

So, when people ask, why don’t we do all micro cap stocks given their big outperformance, I simply show them slide two.

We want microcap exposure and we want to overweight it compared to the normal market weight, but we have eight times more large cap stocks than micro cap stocks for a reason.

My hope and intuition, and it’s just that since four days of data doesn’t tell you anything really, is that investors are not selling indiscriminately anymore and that people have determined that micro cap stocks are oversold.

Perhaps that’s a signal that investors feel that the selloff had gone too far and that we’re at a bottom for now.

Of course, we can’t say anything with much certainty, but it’s nice, for whatever reason, to see that gap close so sharply in a relatively short time period.