Any sensible person knows that you have to save money for the future.

At the very least, you need to have money set aside for the so-called ‘rainy-day.’ If you don’t have a cushion, the consequence of a negative surprise can be a lot worse than if you have an emergency fund set aside.

Do money and happiness go together? Can saving actually make you happier? I wouldn’t have thought so, but a survey released at the end of last year by Ally Bank suggest otherwise. They asked more than 1,000 people what makes them feel good and got these results:

– 59 percent of people said exercising makes them happy

– 74 percent of people said eating healthily makes them happy

– 84 percent of people said saving money makes them happy

Interestingly, they also found that earning money contributes to happiness, but essentially plateaus after household income crosses $50,000. In contrast, the more people saved, the happier they were.

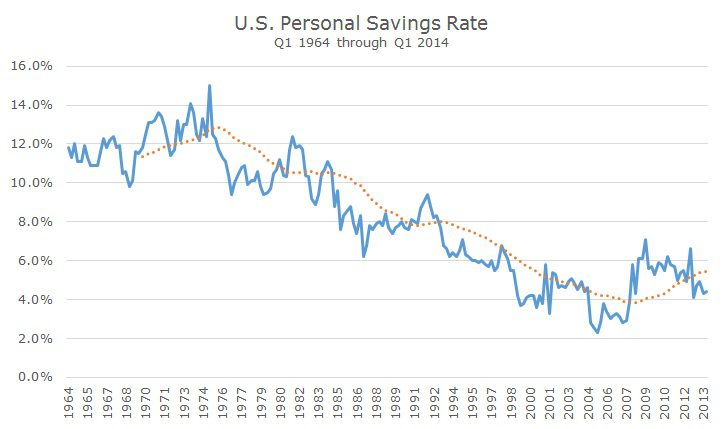

Given that the savings rate has steadily dropped over the past 50 years, I suppose we can assume that we’re a lot less happy than we were 50 years ago (although that’s not the feeling I get from watching Mad Men).

In the short-run, higher savings can hurt the economy since 70 percent of gross domestic product (GDP) at this point is made up of consumer spending. If the market for goods and services slows, that also hurts the market for what’s called the factors of production: land, raw materials and the inputs for the products and services that essentially end up in the hands of consumers.

In the long-run, high personal savings should lead to stronger economic growth. According the Hamilton Project, a Washington DC think tank, the correlation between the national savings rate and the investment rate is still very large, despite the globalization.

That makes sense because when people have savings, they are ultimately investing it one way or another. Even if the money is sitting in a checking account, the bank should be lending the money to other businesses. If investors buy a bond, that’s a loan that can finance a government or corporation. And of course, buying a stock gives a company equity capital to finance their assets.

As I think about the Ally Bank survey that links savings and happiness, I am reminded of a story that I read recently about the books that people buy and don’t read. For people that read e-books, Amazon can track what people buy on their Kindle versus what they actually read.

The Hunger Games book, Catching Fire, has been read by almost half of the people who bought it, which is pretty good according to Amazon. By contrast, the bestselling economics tomb, Capital, buy Thomas Piketty (that I haven’t and won’t read – its 700 pages!) is the least read this summer.

Reading high minded books, eating well, exercising and savings are all things we aspire to, but often don’t do as well in real life. Although there seems to be an increase in national savings after the financial crisis, it’s probably too soon to say whether the long-term trend has reversed.

Like diet and exercise, consistent long-term savings will really make a difference in the long run, so let me paraphrase what they say in Chicago: Save early and save often. And, please, read Daily Insights to the end each day!