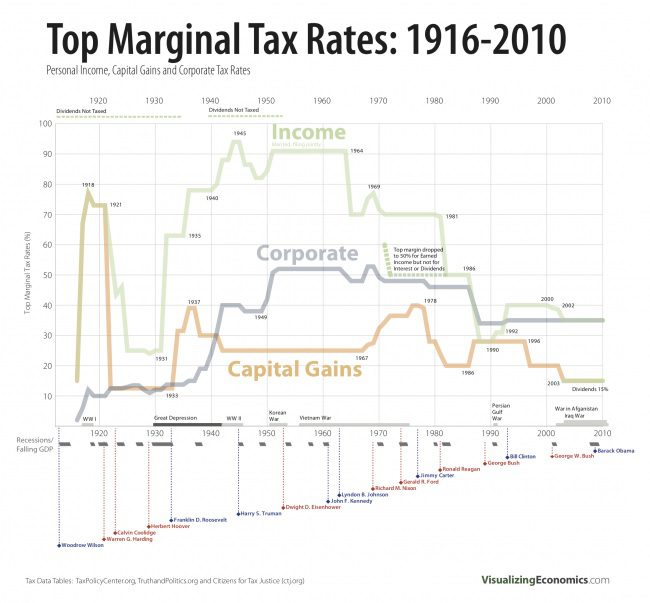

A few years ago, someone forwarded me a chart that showed the history of the top marginal tax bracket. I found a similar chart that you can see below from www.visualeconomics.com with a simple Google Image search.

At the time, I forwarded the image to a trust and estate tax lawyer that I worked with to see what he would say and his response was interesting. He said that the chart was a little misleading because you could only see the top bracket and didn’t know how much money it took to be in the top bracket.

He was right, although in my opinion, it doesn’t matter what your income is – a top marginal rate of more than 90 percent is too high. A while back, someone told me that a tax rate of more than 50 percent violated the ‘search and seizure’ amendment to the constitution. I have no idea about the legality of that claim, but the argument makes sense to me.

In any case, I found an amazing website yesterday that has the entire history of tax rates and brackets dating all the way back to 1862. (Here’s a link to the data)

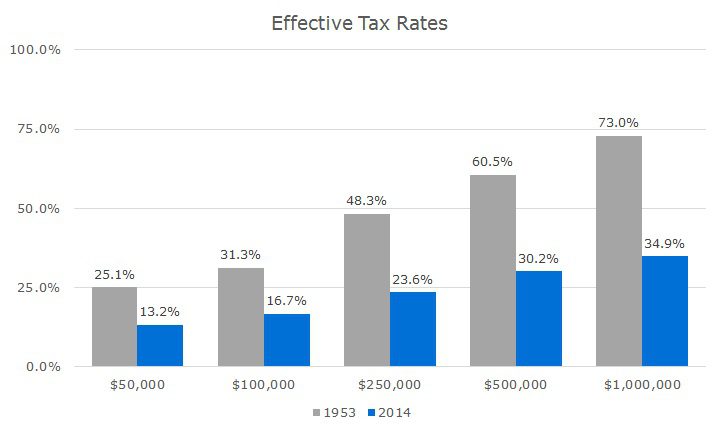

I decided to look randomly at one of the high tax bracket years and picked 1953 out of a hat, just to see what the brackets looked like. Kindly, the website, www.taxfoundation.org, offers the data in nominal and inflation-adjusted terms, so I didn’t have to do any calculations.

There are too many brackets to print here (24 brackets!), so I will just pick a few incomes and see what the marginal and effect federal taxes were then and today. Also, this is a rough cut analysis – there are no adjustments for deductions, exemptions, etc.

I have to say that I am pretty amazed. Almost across the board, the effective tax rate is about half of what it was about 50 years ago – and that’s after the recent tax hikes. Of course, I don’t factor in state taxes, the new Medicare surcharge, etc., this is just a broad look at the big picture.

When I look at this data, a few things leap to mind. First and foremost, if history is any guide, taxes could be a lot higher in the future than they are today. I’m guessing that tax rates were so high because we had to pay down the debt related to WWII. If our current debt problems really tip, we’ll be looking at higher taxes along with lower expenditures/services.

If we are in a low tax-regime today, it makes sense to reduce or exit concentrated positions. I didn’t look up capital gains tax rates, but it I suspect they are lower today than in the past.

I also think it makes sense to use tax-free accounts when possible. For example, our company 401k plan offers a Roth option, which means forgoing a deduction today in exchange for tax-free withdrawals in the future. Just like we diversify across asset classes, sectors, industries, etc., it makes sense to diversify your holdings by tax status, when possible.

As much as it hurts to pay taxes, it has hurt a lot worse in the past and could hurt more in the future.