We like to say that we eat our own cooking because we invest your money the same way that we manage our own.

As one of the chefs in the kitchen, I also eat a lot of things that I’m not ready to serve. For better for worse, my account operates like a test kitchen. Some of the experiments turn out unexpectedly well and it is served out to everyone else and sometimes it turns out horribly and would make your stomach turn.

Either way, there’s no better method for learning how a strategy or product works. When your own money is at risk and you live with it for a while, you really understand how something works and how it may or may not fit with what you’re doing for clients.

For a little more than five years, I’ve been experimenting with ‘alternative’ investments in my own account and I’ve finally come to some conclusions about how they should and shouldn’t be used.

First, let me define what I mean by an alternative investment since some people include fairly mainstream asset classes like Real Estate Investment Trusts (REITs) or Treasury Inflation Protected Securities (TIPs), which are pretty pedestrian in my view.

In my opinion, an alternative investment is an asset class or strategy that produces returns from sources other than the classic approaches for stocks and bonds. If we can explain the results of a strategy with the models that we use to evaluate stocks and bonds, then it isn’t an alternative. Furthermore, an alternative investment has to be lowly correlated with stocks or bonds.

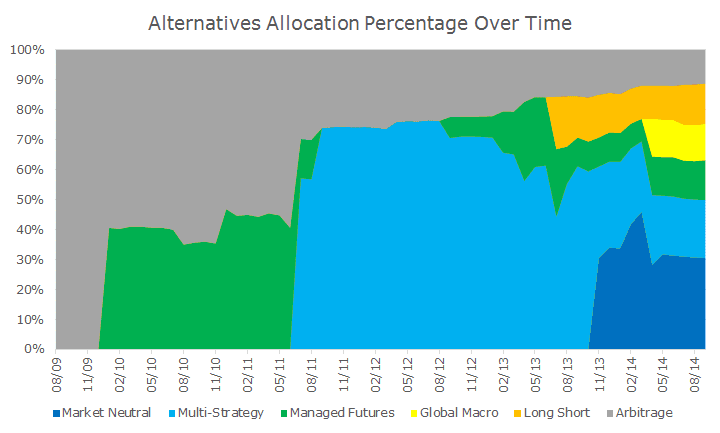

Over the last five years, I’ve invested directly in four basic strategies (each with multiple sub-strategies) to varying degrees, as shown in the chart below.

Five years ago, there were very few alternative funds available in mutual fund formats. It also took me a while to get comfortable investing my own money, so for a while, I only pursued two strategies, arbitrage and managed futures.

It would take me forever to really describe the strategies so, for now, let me just say that arbitrage attempts to profit from small price dislocations, usually from illiquid market conditions. Managed futures is a trend following strategy that buys what’s gone up recently and sells short what’s gone down recently.

When I found a multi-strategy fund that included arbitrage and managed futures and a variety of other strategies, I shifted to that approach. In the last year, more products became available that allowed me to invest directly in global macro (economic based bets) and long-short equity (buy ‘good’ stocks and sell short ‘bad’ stocks).

So how have I fared? It depends on how you look at it. I earned returns comparable to the Hedge Fund Global Index (HFGI), which earned a little less than three percent per year.

My returns happened to be a little less, but were also less correlated to stocks, and our models did a poor job of explaining the results – which is desirable in an alternative strategy.

Regardless of how I did versus the HFGI, the question remains whether these strategies make sense. If you are comparing the results to stocks, then they did terribly, but it’s been a straight up market. If you compare the results to bonds, they still weren’t as good, but interest rates have fallen over the last five years.

If the returns of the last five years are consistent with the long term results, which is difficult to say since long-term data doesn’t really exist, then you can only consider alternatives as a bond replacement. That said, we generally think of bonds as the ‘safe’ side of the house and there are meaningful risks built into alternative strategies that could really hurt just when you want safety and stocks are falling.

CALPERs, the huge California pension, just announced that they don’t think the strategies make sense and are exiting hedge funds in general (more from us on this subject here).

CALPERs may be guilty of recency, the tendency to project what’s happened recently into the indefinite future. If the results had been good, you can bet that they would have maintained or increased their exposure – despite what they say, institutional investors are performance chasers too.

So, what will I do next? I will probably reduce my exposure overall and consolidate the holdings to just two funds. I have a good handle on how they work, still believe that some of the strategies are conceptually sound and am comfortable with the risks.

While I am comfortable investing in these strategies for clients, we think it’s best done on a limited basis and the strategies don’t quite pass the basic taste test for broad application across all clients.

I’m going to keep cooking, I love being in the kitchen.

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott