Precision in language matters, though you wouldn’t know it from reading newspaper headlines (Gator Attacks Puzzle Experts). It may seem like distinction without a difference, but I want to make a distinction today between passively managed funds and index funds.

One of the biggest debates amongst investors is the old ‘active/passive’ debate. I’ve spilled plenty of digital ink on this subject already (click here, here and here), but the basic argument is that funds with managers that pick stocks generally underperform indexes. There’s more to the debate, but I want to focus today on the difference between ‘passive’ and ‘index.’

In my last paragraph, I was intentionally sloppy with my language and I’ll bet no one noticed. In the first part of sentence I used the word ‘passive’ when framing the debate, but in the second part of the sentence, I compared an active stock-picking manager to an index. While the sentence was basically accurate, I conflated the terms passive and index.

The term passive refers to the market portfolio where stocks are weighted by the size of the company, or market capitalization. There’s only one passive portfolio and it contains all of the publicly traded securities in the world. Let’s simplify that statement and simply say all of the stocks in the US, all four thousand (or so) of them.

Interestingly, there is no index fund that tracks the market portfolio. Unfortunately, real world constraints like liquidity (the ability to buy and sell without impacting the price) make indexing the true market portfolio impossible, so index creators like S&P, MSCI and FTSE create rules for their indexes to follow to deal with those constraints.

In the early 1980s, Dimensional Fund Advisors (DFA) created a mutual fund to invest in the smallest publicly traded stocks, which are known as micro caps, in an effort to earn a higher return than the overall market based on academic research.

The academics concluded that microcap stocks had historically earned higher market returns than the total market based on a series of indexes that the academics created to study the market. DFA realized at the start they couldn’t track the index very closely because the costs associated with the illiquidity would have eaten up all of the additional expected returns.

As a result, DFA created a passive managed portfolio that wasn’t indexed. As a matter of fact, it was another 20 or so years before any of the index companies created a microcap index. The Russell Microcap index was designed do the same thing that DFA was actually doing with their portfolio, but to make an index that investors could efficiently track required some tradeoffs surrounding transaction costs, liquidity, and turnover.

DFA concluded that passive strategy was better than the index that Russell created and continued managing their portfolio passively without following an index. Over time, DFA has made several enhancements to their strategy, but still don’t track the index.

Even though DFA isn’t tracking the Russell Micro Cap index, we decided to put the index on our reports to give a sense of how the passively managed fund is doing compared to the index.

Over longer periods, measured in a few years, the fund has done better than the index, but there are periods where the performance diverges wildly. Unfortunately, the last six months was one of those periods.

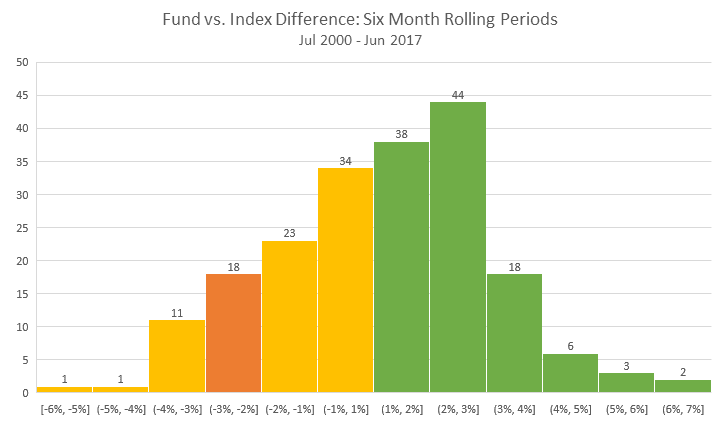

The chart above shows the differences in return between the fund and the index dating back to the inception of the index in July, 2000. The columns in green indicate the six month periods where the fund outperformed the index, which total 138. The column in yellow (and orange) represent the periods where the index outperformed the benchmark, a total of 88.

About 40 percent of the time, the fund has underperformed the index, sometimes significantly. There was one six month period where the fund underperformed the index by between -5 and -6 percent. The past six months, the fund underperformed the index by -2 and -3 percent. It’s happened 17 times before since the inception of the index.

We obviously believe that the fund will fare better than the index over time, as it has in the past. If we didn’t, we would simply buy an index fund that tracks the index (although, somewhat surprisingly, the index fund is more expensive than the fund we use, maybe because it has to pay licensing fees to Russell).

Ultimately, what I’m trying to say is that while we are using passively managed funds, we aren’t using index funds, which means that we can deviate from the indexes substantially. If you don’t know that there is a good reason for the funds to diverge from the indexes, it might seem scary to see such a dramatic underperformance in such a short time period.

If you’re in the know as we are, however, and can see the longer term data, it makes sense and you can bite your lip and hold on to see what the next six months, nay, six years will bring.