About one month after Lehman Brothers collapsed during the 2008 financial crisis, Warren Buffett penned an opinion piece for the New York Times that I found immensely comforting.

You can read the article by clicking here, but the thrust of it was that even if he didn’t know what stock prices would do in the short-run, that stocks would make record profits in the future and he was buying stocks.

My favorite line was that ‘if you wait for the robins, spring will be over.’

A few weeks ago, when stocks were melting down, I hoped each day that Buffett would put pen to paper again and tell us to be greedy when others are fearful.

No such luck.

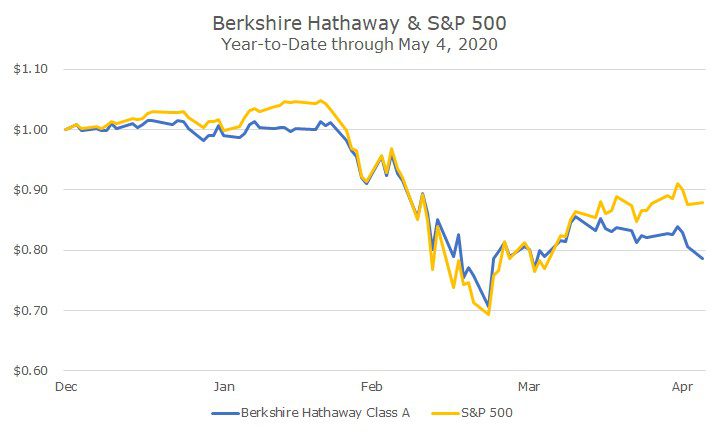

Buffett was quiet during the panic, but spoke over the weekend at the virtual Woodstock for Capitalists at the Berkshire Hathaway annual meeting.

At the meeting, he said that he has $137 billion in cash, but that ‘we haven’t done anything, because we don’t see anything that attractive to do,’ but added ‘that could change very quickly or it may not change.’

He said that he’d be willing to do something very large, as much as $50 billion, for an attractive deal.

And, he got a lot of attention for selling his airline stocks, which is easy to understand at this point (there are 14 flights scheduled at LaGuardia today).

But, even though he was quiet last month, has sold some stocks and hasn’t bought anything, he had an important message for us:

Nothing Can Stop America.

He added that ‘the American miracle, the American magic has always prevailed, and it will do so again. In World War II, I was convinced of this. I was convinced of this during the Cuban Missile Crisis, 9/11 and the financial crisis.’

Although he didn’t say it, I’m sure that he would tell us again that he has no idea where things are going in the short-term, but that over the long-run, it’s a good idea to bet on American stocks.

We prefer globally diversified portfolio of stocks with a substantial over-weight to the US, but we’re on the same page.

And while it’s hard to disagree with the most successful investor of all time, we take a far more diversified approach than Mr. Buffet (for a multi-year period a few decades ago, he had 50 percent of his portfolio in one company – wow!).

Still, I’m reminded of one of my favorite quotes of his:

Someone’s sitting in the shade today because someone planted a tree a long time ago.