David Swenson, the pioneering manager for the Yale Endowment passed away last week, after a long battle with cancer.

Swenson is among the few investors that will receive an obituary, along with other legendary investors like Warren Buffet, Peter Lynch, Bill Gross, and George Soros (Soros is complicated because he’s one of the most incredible investors of all time, but is mostly known for his political views and activities, which is outside of our interests at Acropolis).

These investors changed investing. Charlie Ellis, the Chair of Yale’s Endowment between 1997-2008, notable investor and author of ‘Winning the Loser’s Game’ and several other books said it well: ‘The really great painters are the ones that change how other people paint, like Picasso. David Swenson changed how everyone who is serious about investing thinks about investing.’

When Swenson took over the Yale Endowment (his alma mater) in 1995, it had about $1 billion in assets and was a traditional 60/40 stock/bond allocation. Today, the endowment is $31 billion and has returned 12.4 percent per year over the last three decades, which is 2.7 percent more per year than the S&P 500. His strategy is now known in the industry as the Yale Model.

When he was just 46, he published one of the most influential books on investing, Pioneering Portfolio Management. His track record at that time was a little better, around 17 percent per annum, and people were highly interested in how he did it. Thanks to the Yale Investments annual letter (which can all be found here), we can see how he did it.

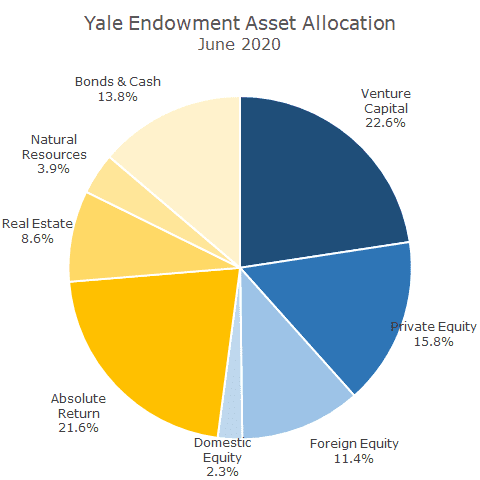

This is the Yale asset allocation as of the last report:

I’ve organized it a little differently than the report and changed a few of the labels in order to better explain the portfolio. First, I’ve color-coded the assets – blue is for stocks, and yellow is for bonds and alternatives, which I’ll get into more in a minute. But the big idea is that the portfolio is roughly half risky investments (stocks), and roughly half less risky investments (other).

Notice that among the blue pie slices, that US stocks are tiny, just 2.3 percent. Foreign stocks are another 11.4 percent, which means that publicly traded stocks, like the ones that we own, are just 26 percent of the equity allocation and 13.7 percent of the total portfolio.

The dominating slices of the equity allocation are venture capital and private equity (called leveraged buyouts in the report). Venture capital is investing in start-ups, and while most start-ups fail, a handful go on to be so spectacularly successful that the winners hopefully pay for all of the losers and then some.

Yale made early investments in a number of companies before they went public that you may have heard of: Amazon, Google, Dell, Amgen, Pinterest, Snapchat, Cisco, Red Hat, Facebook, Twitter, Uber, Airbnb, etc. In one letter, they note that a $2.7 million investment in LinkedIn turned into $84.4 million.

Yes, this is Yale’s secret sauce. In the 2015 letter, they write that their venture capital portfolio’s return since 1976 is 33.8 percent. Yowsers!

I did some quick math a few years ago and think that almost all of the excess return of their portfolio came from venture capital. That makes sense to me because almost no one has been able to replicate Yale’s success and Yale has a few advantages that others don’t.

First, some of the venture capital pioneers are Yale graduates, like William H. Draper and Roger McNamee. I don’t know the numbers, but I can easily imagine young Yale graduates heading to Silicon Valley at start-ups and venture capital firms who would be willing to take a call from Swenson.

To me, the Yale network answers the question of why most other endowments pursuing the Yale Model haven’t fared nearly as well. Plenty of salespeople have come into our offices pitching products to try and do what Swenson did, but we never bit and are better off for it. In addition to not having a network, Yale can get better terms than we ever could – an investment from Yale is like a Good Housekeeping Seal of Approval and can make or break a start-up.

That’s true of the private equity portion of the portfolio. Like venture capital, private equity is about access to high-quality managers, and even with $2 billion under management, we don’t have enough assets to get access to good managers. And, I’m not sure that our client base is willing to accept the loss of liquidity even if we did have access. Yale is different because, unlike our clients, their time horizon is eternity.

In the not-so-risky assets, you can see that cash and bonds are a relatively small allocation and that much more money is dedicated to absolute return strategies.

Absolute return, a term that Swenson coined, refers to market-neutral strategies like merger arbitrage or convertible bond arbitrage. These terms might not ring any bells in your mind, but they are well-known strategies that try to take advantage of structural dislocations in the market related to corporate actions or liquidity. These strategies can have bond-like returns but have different risks.

Natural Resources and Real Estate isn’t buying gold mining stocks or REITs, as individual investors might. Yale buys whole office buildings and logistics centers and collects the rent as the landlord. They buy whole forests and harvest the timber for income while assuming that the land will appreciate with inflation. These are more strategies that aren’t easily replicated by investors without massive scale.

Even though Yale’s returns haven’t been quite as good over the last decade, Swenson deserves to be in the pantheon of top investors. His embrace of diversification, material stock allocations, and traditional investment theories that we can all get behind. And even if we can’t replicate his use of illiquid investments or active management where he has a true edge, we can admire them from afar.