I sometimes include changes in the dollar in the market summary that precedes the data table above. I cover the dollar less and less, though, because it’s so abstract. That said, the dollar has been immensely strong recently, and it’s impacting our portfolios.

Any patriot likes the sound of a strong currency – after all, a strong currency should reflect a strong country. And a weak or debased currency is the sign of a country in trouble. We all know that the Wiemer Republic currency was better used as wallpaper and burned for heat.

More seriously, there are advantages of a strong dollar: it’s cheaper to travel since our same dollars go further elsewhere, but that’s small potatoes. Imports from other countries are cheaper too, which is good for fighting inflation.

But the most important reason for wanting a strong dollar is that it bolsters the dollar as the world’s reserve currency.

The dollar’s status as the world’s reserve currency means that central banks around the world hold dollars and our dollar-denominated bonds. The dollar is used in all kinds of investments around the world, and even oil and gold are priced in dollars.

So, I do want a strong dollar, and I want the dollar to remain the world’s reserve currency. But as an investor in nonUS stocks, I also could use a break from the strong dollar.

We allocate 20 percent of our stock allocation to developed market stocks like Germany, Japan, and Great Britain. Then we invest another five percent in emerging markets like China, India, and Taiwan.

Allocating to other countries means that we are globally diversified, which should lower the risk of our portfolios. It also means that we have some exposure to foreign currencies.

So not only do we have exposure to Nestle as one of the largest nonUS stocks in the world, but we also have exposure to the Swiss franc since that’s where Nestle is located. They do business in the US and elsewhere, so it’s an imperfect analysis, but hopefully, you get the idea.

Over the very long run, the currency impact should be minimal, but that long run can be pretty darn long, especially when you’re living it one day at a time.

The chart below shows the index of developed market stocks with the embedded currency risk in blue. I’ve compared it to the S&P 500 in gray since that’s what we all anchor around (rightly or wrongly).

But there’s a third line, in orange, that shows what we would have earned since 2014 if we weren’t taking currency risk – if we had hedged that risk, so all of our portfolio risks were in dollars.

Obviously, hedging the currency risk wouldn’t have meant that we would have gotten S&P 500 returns, but it would have added four percentage points per year over this time frame, which is a pretty big deal. And it would not have materially changed the volatility or correlation.

So why didn’t we do this? Because like timing the stock market or the bond market, timing different currencies isn’t feasible either. Yes, George Soros made a billion dollars betting against the British pound in the early 1990s, but that was an outlier event (and I think he lost $700 million on the yen a few years later, but I’m not sure about that).

The hedge products are also more expensive than the non-hedged version. The fund that most frequently serves as the core of our developed markets exposure has an internal expense ratio of 0.05 percent. I haven’t done an exhaustive search of hedged developed market funds, but the one that I follow is 0.35 percent.

Yes, over the last six years having the hedge was worth far more than the extra cost, but since we don’t think we can time currency markets and that it won’t matter over the long run (which, I grant, is pretty long), we’re satisfied with the cheaper option.

But, despite my patriotism and a deep desire for the dollar to remain as the world’s reserve currency, I wouldn’t mind a little dollar weakness for a while – maybe when inflation is a little tamer so that import prices don’t rise any faster than they already are now.

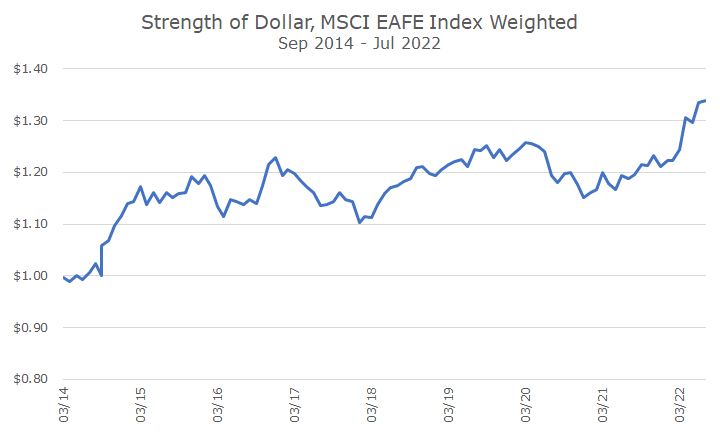

BONUS CONTENT: I created this chart before I wrote the article, but didn’t know where to work it into the article. So, I’m throwing it at no extra charge! It shows the strength of the dollar in the context of the MSCI developed markets index. There are many ways to calculate the dollar, but this one is the one that I care about when looking at developed market stocks (and yes, it looks pretty different for emerging markets).