Lately, I’ve been interested in looking at strategies that have struggled in the past, in part because some of our strategies are struggling right now.

Take value, for example, the strategy of buying cheap stocks with the idea that they outperform the overall market over time. It’s a tried and true approach dating back to the 1930s, but the last year has been so rough that the 10-year track record is negative. (Click here and here for some more detailed write ups).

I’m not worried about value over the long run, but I do get concerned sometimes that clients won’t have the patience to live through the tough times and will bail out before things turn around.

And, of course, I can’t console folks with the promise that they will turn around – we don’t know when or if strategies will ever reverse course. We have the historical record as evidence and a strong theory, but as far as the future goes, promises are hard to make, especially in a regulated industry like ours.

But here’s an example of a strategy that we don’t pursue that had a tough time in 2008 but came roaring back in the following years. The strategy, known as portable alpha, is pretty clever. Here’s the idea in a nutshell: instead of buying a portfolio of stocks that track the S&P 500 like Vanguard, buy S&P 500 futures contracts, which should get you the same result.

Since futures contracts have embedded leverage in them, you don’t need to spend $100 of cash to get $100 of market exposure, like you do when you buy the individual stocks. Instead, you may spend something on the order of $20, which leaves $80 free for other purposes.

If you can take that $80 and buy bonds that earn more than the financing costs embedded in the futures contract, you’ve made more productive use of your money (there are a lot more details here, but this is the basic idea).

There’s at least one fund out there that does this in a large scale way, and it’s run by PIMCO, so it’s a fair bet that they will do a reasonably good job with the bond portion of the portfolio. We don’t use their funds because they tend to be expensive black boxes, but on average, the results have been good over the long run.

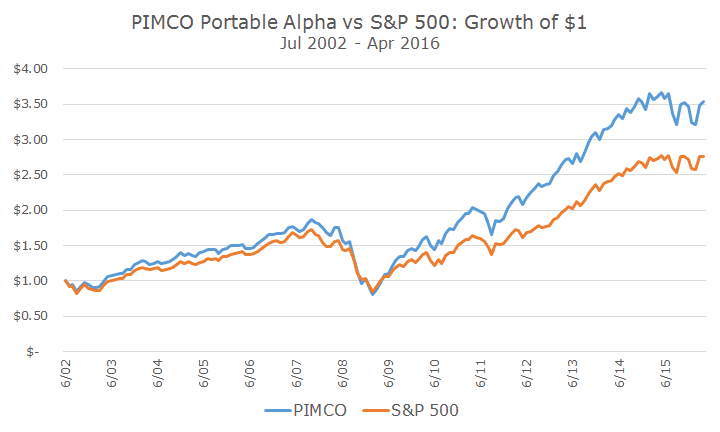

The following chart shows a snapshot of the results for their portable alpha fund that follows the S&P 500:

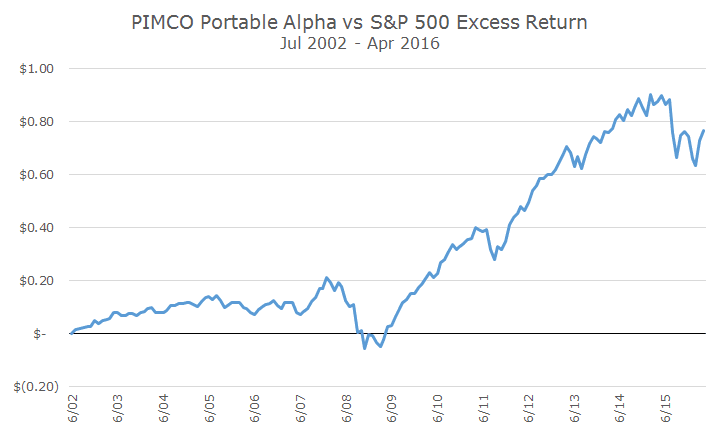

You can see in the picture that PIMCO outperforms a little bit from the inception of the fund in 2002 until the 2008 financial crisis, falls and then sharply outperforms in the following years. I like to isolate the outperformance to get a better feel for it, which is what the following chart shows:

In this chart, the problem in the 2008 financial crisis is more acute, all of the cumulative excess return since the inception of the fund is swept away in a short time period. If it was 2008, you can’t see how good things get from there and that you should hold on.

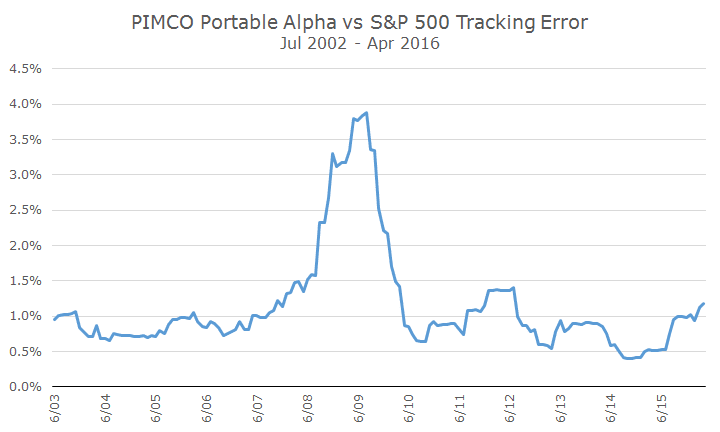

Another way to see how haywire things got for this fund in 2008 is by looking at a metric called tracking error. I need to do a piece on this to explain it more fully, but basically it shows how much a fund tends to deviate from a benchmark.

In this case, in the early years, the fund doesn’t stray from its benchmark by more than a percent in any given month, but in 2008, the returns are markedly different – four times more by this measure. Who had the temerity to stick with this fund during this dark period?

We wouldn’t have because we don’t like the black box nature of the bond fund that has 80 percent of the money. We do have the nerve to stick with value (and the other things that aren’t working right now) because we think the data is strong and the theory for why value should work is sensible.

Whether or not we believe isn’t necessarily the question, though, it’s whether clients believe. I hope that you feel like you’re getting enough of an education from your team at Acropolis, but if you have any questions in private or questions to be answered for all of the readers, let me know and I will put answering your question at the top of my writing agenda.