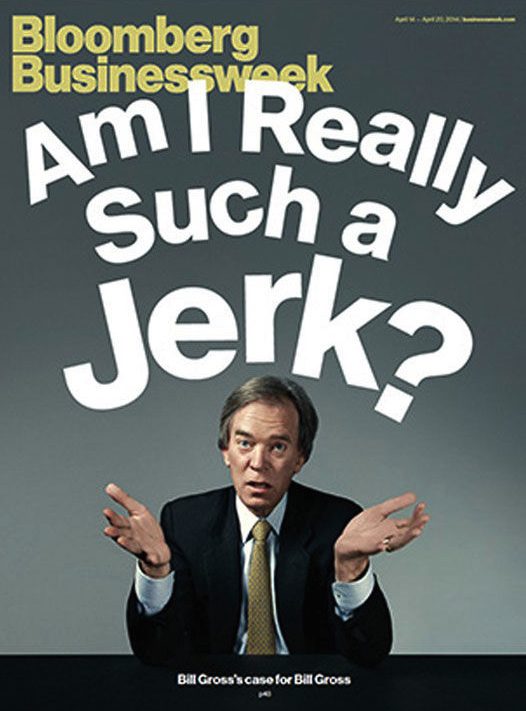

Yesterday, I came back from lunch and found the most recent Bloomberg Business Week on my keyboard so that I couldn’t possibly miss it. The cover features a confused and slightly incredulous Bill Gross, the Chief Investment Officer (CIO) of PIMCO and general bond king with the headline, ‘Am I really Such a Jerk?’

I am not sure whether this magazine was left for me because someone knew that I would like more details on the long-running saga at the top of PIMCO or because they think I am a jerk, I’m not sure but will assume the former.

The soap opera began in January when the former co-CIO of PIMCO, Mohamed El-Erian, abruptly resigned from the company to the surprise of the investment community.

Just a few weeks later, the Wall Street Journal ran a story that detailed some of the in fighting and between Gross and El-Erian and, in particular, Gross’ unusual and difficult behavior at the helm. Of all of the stories, my favorite was that Gross doesn’t want employees speaking with him or making eye contact with him.

At the same time, the performance of Gross’ flagship fund, PIMCO Total Return, has been tepid at best. After many years of beating the Barclays Aggregate Bond index, the fund has struggled recently.

Over the past year, the fund underperformed by -1.56 percent and -0.21 percent over the past three years. Over the past five, 10 and 15 years, the fund has still outperformed by 1.53, 0.92 and 0.69 percent per year respectively.

Last year, when the bond market faltered and the fund underperformed, the fund lost $40 billion in assets under management. The fund is still enormous and is at levels about like 2011, but the combination of poor performance, asset outflow and trouble at the top has the investment community wonder what’s going on inside the castle.

Fortunately, we don’t have to worry about this kind of problem because we don’t use any mutual funds with ‘star’ managers. Over the years, with the exception of Peter Lynch, we’ve seen star managers fall apart after a streak of hot performance. The Morningstar Manager of the Year is a good proxy for this circumstance, as we chronicled in January.

Instead, we use funds that are team-managed and, more importantly, are process-driven so the talent can’t leave for another firm, have personal problems or just run cold in general. We much prefer low-cost, repeatable strategies that don’t rely on the gut feelings of a single person. You could say that we don’t want the concentration risk of a single manager and would rather diversify talent across firms and multiple people who adhere to a disciplined, academically supported and time test-tested strategy.

So there’s no real reason for me to follow the current PIMCO story other than what the Germans call schadenfreude. Truth be told, I had read the Business Week article days before when it first hit my iPhone newsstand. As my grandmother used to say, ‘I love my stories.’