I am as happy about the strong market rally as the next guy. Still, I was caught off guard when I saw that the S&P 500 is up 25 percent per year since the bottom around the pandemic.

Of course, the Financial Times journalist said that they picked an unfair start date since stocks were down about a third at that point. But still, even if we pick a neutral start, say five years ago, it’s still up 15 percent.

And whether you start at the pandemic or five years ago, it includes a full bear market in 2022. From the bottom of that decline, the S&P 500 is up about 50 percent.

Again, I’m happy about rising prices, but it also makes me a little uneasy. When markets are struggling, I feel like part of my job is to do a little cheerleading, and when markets are exuberant, I feel like part of my job is to temper expectations.

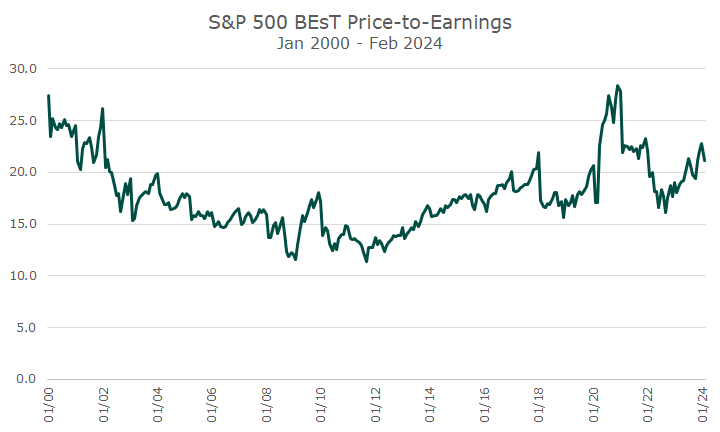

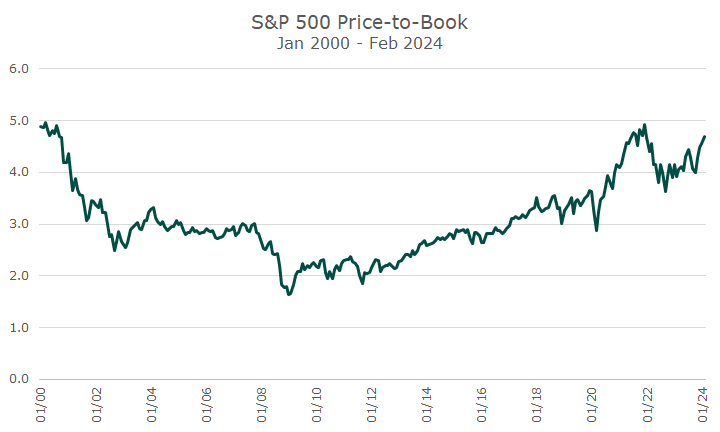

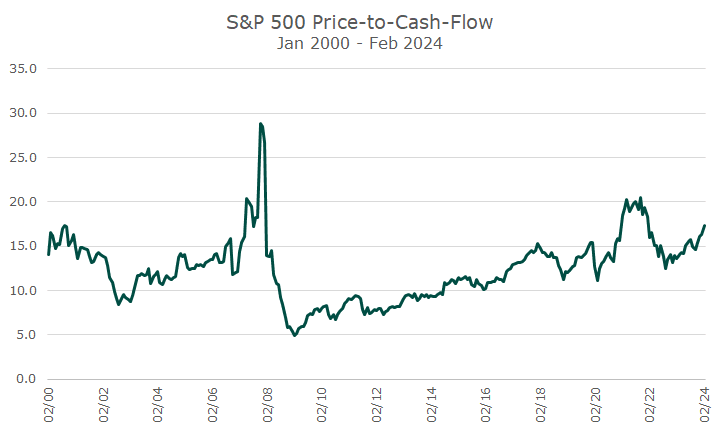

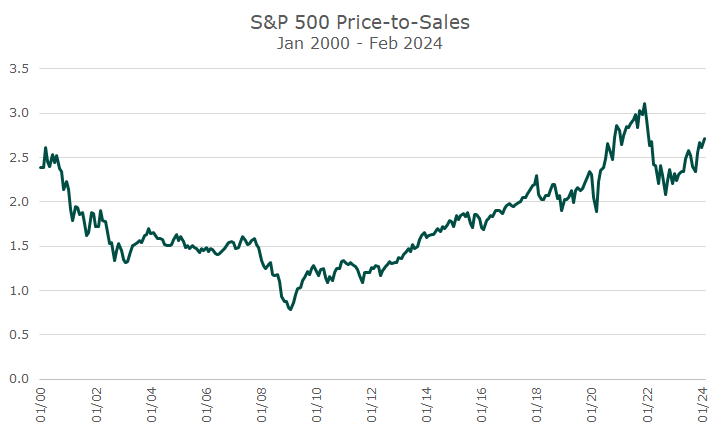

Last week, I was talking to a colleague about the forward price-earnings ratio of the market, and how it compared to history. I started to write the article about that, but then I looked up some other metrics, and rather than pick one or the other, I’ve put them all in below.

Each metric has plusses and minuses, and I could have thrown up a few more, but the story is the same across all of them: valuations are high 25 years ago at the tail of the dot-com bubble, then get really cheap in the 2008 global financial crisis, and they’re expensive again right now (but not as badly as they were in the go-go days of the mid-pandemic).

We don’t need further confirmation to say that markets are rich, but if you look you don’t have to look far: a Bitcoin is trading around 67,000, compared to 16,000 at the end of 2022.

Reddit, the internet thing (I don’t understand Reddit), loses buckets of money every year, but went public last week and already trades at nine-times sales. They’re going to sell a lot of memes, or whatever, to justify that price. (Does this make me sound old?)

Of course, I don’t advocate doing anything out of the ordinary with this information. One of my articles that I remember the most is saying that the market was overvalued… in February 2014. It’s a good article, which you can find here, but stocks are up about 2.5x since then (even with some major drawdowns along the way).

Thankfully, I didn’t advocate ‘getting out’ then either. We’ll keep doing what we always do in expensive markets: tilt towards cheaper stocks (value, which isn’t as expensive), stay diversified, and rebalance. Right now, rebalancing means selling S&P 500 stocks and buying other equity markets or cash and bonds.

In down markets, I like to say “we’ve planned for this,” meaning that we know losses are part of the equation. It turns out the same thing is true in up markets, and after more than 20-years of doing this, we’ve got a playbook that works.

Enjoy the visuals!