Many years ago, I somehow discovered a newsletter called International Living that showed how you could retire overseas and live well without a ton of money. The basic idea was that your Social Security check would go a lot further in Prague than in Philadelphia.

The magazine (and now website www.internationalliving.com) always featured beautiful photographs of unspoiled beaches in Costa Rica, wandering streets of old Italian villages and had the feeling of a travel brochure as much as strategy for how to deal with not having saved enough.

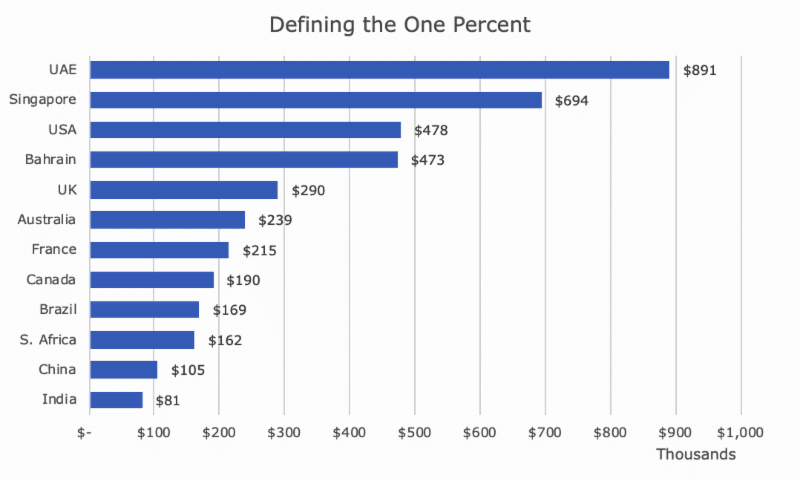

I hadn’t thought of International Living for five or ten years, but was reminded of it when leafing through Bloomberg Markets magazine, which had an article showing how much income it takes to be in the top one percent of earners across the world.

The country that takes the price for highest income required to be a one-percenter by income is the United Arab Emirates, where the threshold is $891,000 – almost double what it takes to be at the top in the USA.

It was actually India that made me thing of International Living, because to be in the top one percent of income earnings only requires $81,000. A couple that each earned enough to pull the maximum allowable amount out of Social Security will make almost $69,000 in 2019.

Of course, a couple that pulls that much out of Social Security probably doesn’t need to move outside of the US to make ends meet, but I was struck by how a couple on Social Security could live like kings in India.

Then, I remembered International Living, surfed over to their website and found that the cheapest place to live in retirement are Bolivia, Peru,Thailand and Vietnam.

The only problem in mind, is that I don’t want to live in any of these places! I would like to visit all of them, but living overseas isn’t my cup of tea – especially in retirement, when I’ll want to see my grandkids and won’t want to rely on a foreign healthcare system. Maybe I’m not being fair, but that’s how I feel.

In 2015, I wrote about how the Milken Institute has done a bang-up job researching the best cities to retire. You can find my article here, but the ratings have changed a little bit.

According to the Milken Institute, the three best large cities in the US are Provo UT, Madison WI, and Durham-Chapel Hill NC. The best small cities are Iowa City IA, Manhattan KS, and Ames IA.

I’m still gravitating towards suburban St. Louis, even though we only rank 27th on the list.