Every year, the investors and the financial media eagerly await Warren Buffett’s annual letter to shareholders, and this year was no exception.

I didn’t start reading them until four or five years ago, although I once read book that reorganized his letters by topic rather than chronology. Each year, I like to think that I’ll go back and read his letters, which can be found here, on Berkshire’s hilariously antiquated website – but I haven’t gotten to it just yet.

I thought this year’s letter was a little boring. I only skimmed it, so maybe the action is somewhere in the nuance, but I like his broad commentary, and this year’s seemed light on that.

The only thing of interest, in my opinion, was the problem with using his excess cash to buy investments. He said, that “the immediate prospects for that, however, are not good: Prices are sky-high for businesses possessing decent long-term prospects.”

It sounds to me like he thinks that stocks are expensive, although it isn’t clear whether he’s referring to publicly traded stocks or privately held business that he could buy outright.

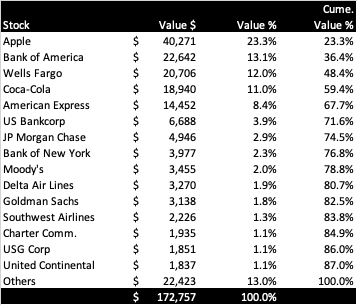

I also spent some time looking at his investment portfolio, which hasn’t changed much in recent years. He sorted the table alphabetically, but I wanted to see the holdings by position size.

I was struck, as I often am, by the relative concentration in his portfolio – the largest position is 23.3 percent of the portfolio, and the top 10 holdings come to about 80 percent of the portfolio.

We’re often asked why we don’t invest like Buffett – why we’re so diversified. I think I’ve answered that over the years, but I want to point out that he’s a little more diversified than he appears.

In addition to the stock portfolio listed above, Buffett has a $129 billion cash and bond position, which would imply a 55/45 stock/cash portfolio if we excluded his private businesses for a moment. His largest position falls from 23.3 percent down to 12.8 percent if we consider his cash and bonds.

Of course, ignoring his other assets would be like ignoring one of the two or three of the presidents at Mt. Rushmore. The total assets of the company are $532 billion, which means that the portfolio of stocks, bonds and cash, are just 56.7 percent of the total.

His largest stock holding is now about 7.5 percent of assets – that’s still a big bet, but a lot less than it first appears.

It’s often retirees that ask us why we aren’t so concentrated, which is interesting, because you’d have to consider Berkshire still ‘working’ if we were thinking about it from a financial planning perspective.

I think you’d have to say that its ‘salary’ was $184 billion in revenue, and it managed to ‘save’ $24.8 billion based on their operating earnings. All but one of the positions in the stock portfolio could go to zero, and the annual operating earnings would replace it one year later (and just 18 months for the largest position).

So, the next time I’m asked why we don’t take big bets like Buffett, instead of talking about modern portfolio theory or some other highfalutin thing, I’ll point out that Buffett’s bets aren’t as big as the appear in light of his other assets and income coming in the door.