Last week, Minjung Son sent the Investment Committee some information showing that the total market value of all emerging market stocks was about $10 trillion. Ryan Craft chuckled and said that was about equal to the three largest stocks in the US.

Although I’ve written about how concentrated the US market is and how emerging markets haven’t done all that well in recent years, I was amazed that three stocks could be worth as much as all the stocks from China, Taiwan, India, Brazil, South Korea, and another dozen countries.

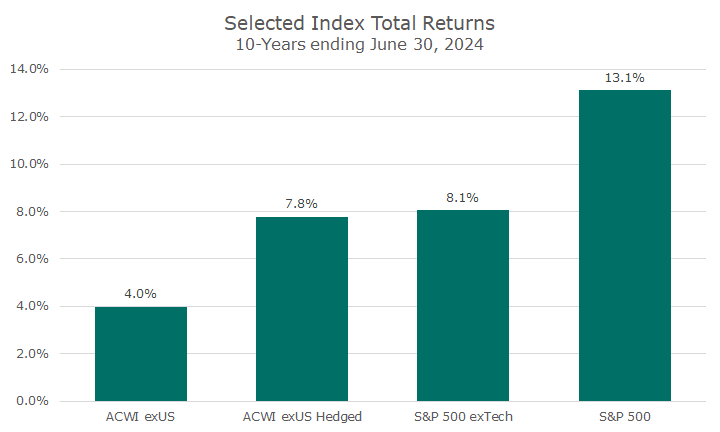

It also got me thinking about the incredible difference between US and non-US market returns over the last 10-15 years. The chart below tells the story.

The column on the far left shows the return for the last ten years of the MSCI All Country World Index, minus the US (or ACWI exUS). That hardly rolls off the tongue, but it captures everything outside of the US, developed and emerging. Over the last decade, it’s earned a paltry 4.0 percent in US dollar terms.

That last part of the sentence, “in US dollar terms,” is pretty important because it tells you the returns that US investors have earned based partly on the return of stocks but also on the change in the value of the dollar versus all of the other currencies represented by the rest of the world.

The second column is the same index, but the currency exposure is hedged, which removes the impact of the US dollar, which has been very strong over the last ten years. In fact, it’s been so strong that it costs US investors like us 3.8 percent per year in returns. If we’d hedged the currency risk, the ACWI exUS would have earned 7.8 percent.

So now we can say that foreign stocks have done reasonably well, but we haven’t enjoyed those returns due to currency movements.

The third column shows the return of the S&P 500 minus the return of technology stocks, which we all know have been enormously hot. By comparing this column to the S&P 500 on the far right, we can see that tech stocks alone are responsible for 5.0 percent of the S&P 500’s 13.1 percent per year return. Mamma mia!

Although this isn’t a precise attribution, I think it reasonably explains the massive return differential of about nine percent per year between US and foreign stocks in round turns.

A little more than half of the difference, five of nine percentage points, is due to tech stocks, and four percentage points is due to the strong dollar.

I’ve made a number of arguments about the benefit of keeping a globally diversified portfolio, even though it hasn’t felt like it over the last 10-15 years.

For me, though, the argument just got easier because I know that neither of the effects that caused the massive outperformance don’t seem likely to repeat themselves. Of course, they can, but how much do I want to bet on that? Not too much, actually. I think the US is a great bet, as are tech stocks, but I don’t think it makes sense to go overboard on either, even it costs some return.