Although China has been liberalizing in recent years, one of the most centrally planned aspects of their economy is the value of the currency.

Yesterday, the People’s Bank of China (PBoC), their central bank, lowered the value of their currency against the US dollar by almost two percent, the largest one-day move in decades (although as currency devaluations go, this one was small).

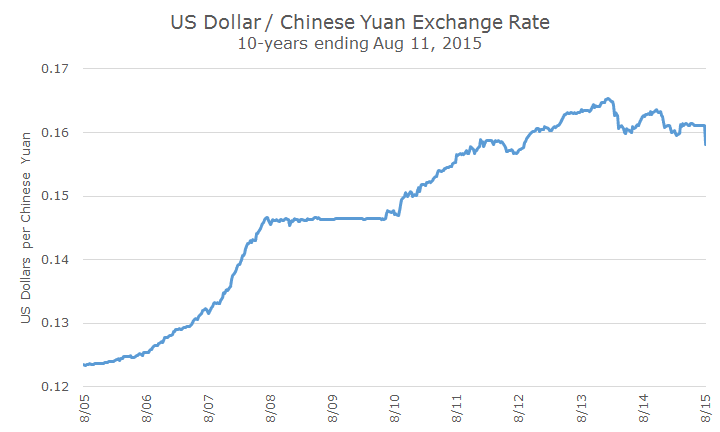

If you look at the chart below, you can see the move at the far right, although it pales in comparison to the strength of the Yuan over the last decade.

In 1994, the Chinese pegged their currency to the US dollar at a rate that the US felt was below a fair market price, which allowed the Chinese to sell more exports. US manufacturers complained loudly that this was an unfair practice and the US Treasury labeled China a ‘currency manipulator.’

In 2004, just before the beginning of the chart, the Chinese said that they would peg the Yuan to a basket of currencies and allow the currency to strengthen over the coming years by more than 20 percent. In the 2008 financial crisis, China halted the rise of the Yuan and informally reintroduced the peg to the dollar. After 2010, they allowed the currency to rise, but to a much lesser degree.

Now, the Chinese government is worried about their slowing economy, sputtering exports and crashing stock markets (which have actually stabilized since July and are still up more than 40-60 percent year-to-date).

Last month marked the ninth straight month of lower exports out of China, which were -8.1 percent lower in July than the previous year. Cutting the value of their currency will help lower the prices of the goods the produce overseas, which the Chinese hope will boost their flagging economy. (To see an example of how a weaker currency helps exports, click here).

But the implications go far beyond the Chinese economy, affecting stocks around the world, commodity prices and global bonds.

Losses were sharp here yesterday, particularly in companies with a lot of economic exposure to China. Just yesterday, Goldman Sachs produced a list of 20 US stocks with significant exposure to China like Wynn Resorts, Qualcomm and Yum Brands (which owns KFC, Pizza Hut and Taco Bell, among other things).

A slower Chinese economy also means less demand for commodities. West Texas Intermediate (WTI) crude fell -3.4 percent yesterday and broke through the lows set earlier this year. A broader measure of commodities, the Thompson Reuters CRB index that equally weights 17 commodities from Platinum to Lean Hogs fell by -1.6 percent.

Partly because stock, bond and currency markets were spooked, bonds had a great day. The yield on the 10-year US Treasury fell from 2.24 to 2.15 percent (when bond yields fall, bond prices rise).

The most interesting aspect, though, is how this news will affect the timing of the Federal Reserve’s decision to raise short-term interest rates. If the move yesterday was the first salvo in a currency war where countries compete to devalue their currency, it could be a real problem for the Fed because they are on the verge of raising rates, which would strengthen the dollar and hurt our exports (and growth) even further.

The Fed seems eager to raise rates, even if it’s just to take them to 0.25 percent, and start the process of normalization. Although I’ve argued before that it doesn’t really matter much to us whether they raise in September, December or early next year, I suspect that the Fed will be indifferent to the Chinese devaluation unless there are further developments.

As always, we’ll just have to see what happens next, knowing that our clients have well diversified portfolios with an appropriate mix of risky and safe assets that should allow them to continue to meet their financial goals and get a good night’s sleep.