Last week’s Daily Insight was a little long and a little technical, so today I am going to keep it short and sweet.

The market appears to have shifted back into rally mode with concerns about inflation, rising bonds yields or volatility, seemingly falling by the wayside. At this point, this correction seems a lot like the last two, although as I said last week, it’s a little too early to call still.

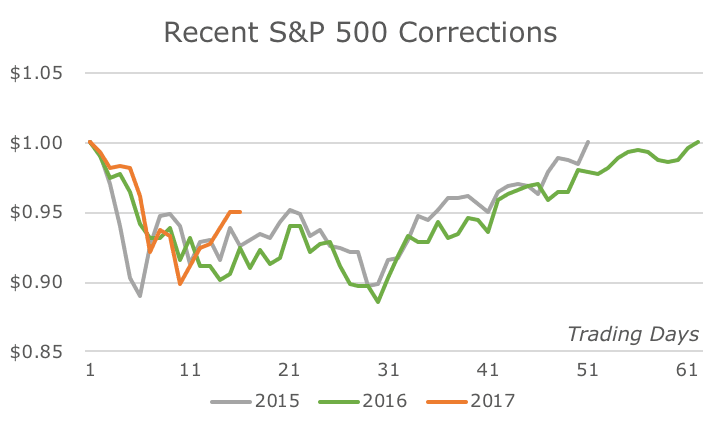

The chart below shows the last two corrections, in gray and green, which date back to 2015 and 2016 respectively. The current correction is in orange.

You can see the selloff at the outset was dramatic for all three corrections and after each had dropped by 10 percent, they bounced around for about 20 days before starting to rally and working off their losses. In both of the previous cases, all of the losses were earned back within 60 trading days.

Personally, I was a little surprised by how quickly each of those corrections reversed themselves. I suppose that I’ll be a little less surprised if this one follows suit, only because the market seems to be conditioning me for quick selloffs and recoveries.

I had planned an article some time ago that shows how long some corrections and bear markets can last. We all lived through a horrible bear market with the 2008 financial crisis, but the recovery from that was relatively fast. For example, developed foreign markets didn’t fully recover from the 2008 crash for until a year or two ago.

In the extreme, the Japanese Nikkei stock market average still hasn’t breached the peak set in 1989. Obviously, that was related to a major bubble, when their Cyclically Adjusted Price-Earnings, or CAPE ratio crossed 100 (compared to 44, for our CAPE in the tech bubble).

Although I don’t think we’re in story for anything like that, I do think we’re getting a little spoiled with these quick and relatively light corrections. I’m all for buying the dip, and it seems to have caught on with everyone, I just want to make sure that everyone has reasonable expectations about what’s possible on the downside.

It appears that we don’t have to worry for now, although conditions can obviously change in relatively short order. And, as always, we’ll keep you posted about what’s happening.