As I wrote earlier this week, the plunge in oil prices has dramatically cut profits for energy firms (see the article here).

Some of those companies have been using their excess cash over the last few years to buy back shares of their own stock, which reduces the number of shares outstanding held by investors.

Last year, I looked at buybacks versus dividends (read the article here) and today I want to focus on whether investing in companies that pursue buybacks is a good strategy.

In theory, buybacks shouldn’t be good or bad for stock prices. Although buybacks result in higher earnings per share and a number of other financial metrics because the share count is smaller, the intrinsic value of a company is unchanged.

As Warren Buffet pointed out in his 1999 annual report, a company should only buy back stock when it has plenty of cash on hand and, more importantly, if the company is buying back stock when the market price is well below its intrinsic value.

The hard part is figuring out when the market price is below the intrinsic value. Management gets this wrong with some frequency.

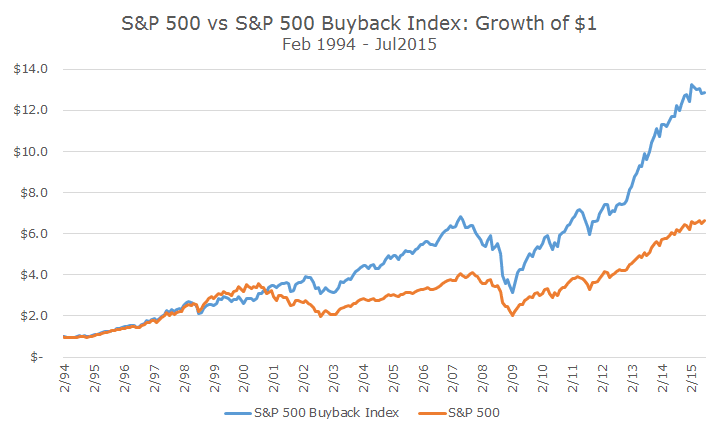

That said, investing in stocks that have bought back their own stock has been a profitable venture as the chart suggests.

A dollar invested in the 100 S&P 500 companies with the largest share repurchases would have earned more than double what a dollar invested in the S&P would have earned since 1994.

While that is wonderful performance, loyal readers may not be surprised to learn that the outperformance can be explained by exposure to our old friends: size, value, momentum and quality. A full 91 percent of the buyback index returns are explained by exposure to the overall market and these factors.

Just like when we deconstructed equal-weighted strategies (click here for a refresher), the exposures in the buyback approach make a lot of sense.

First, there is a lot of exposure to value stocks. As described above, buybacks make the most sense when the market prices are below the intrinsic value. While no one knows what the intrinsic value is, stocks with low price-to-book ratios are a good proxy – Buffett himself will buy back Berkshire Hathaway stock when it trades below 1.2 times book value.

So investing in stocks that are engaged in large buybacks is like investing in cheap stocks. But that’s not all, because not all cheap stocks are in good enough financial condition to be in a position to buy back stocks, so exposure to buybacks also means stocks with high quality.

For this analysis, I used factors created by Asness, Frazzini and Pedersen and the ‘quality’ factor is specifically constructed with returns of capital to shareholders in mind.

There is also statistically significant exposure to size and momentum, but it’s much smaller than the value and quality tilts. The size makes intuitive sense because the largest stocks aren’t usually cheap, so buybacks may not make as much sense.

I don’t have a good story behind the exposure to momentum and won’t pretend to make one up (although the relationship is statistically significant).

An investment in a buyback index might be perfectly fine if you want a lot of quality and value in your portfolio. There is only one ETF tracking buybacks that I could find, although it wasn’t based on the S&P index that I studied for this article.

Moreover, it’s a relatively expensive fund and if you can find other products that offer the same exposure at a lower cost, then that’s the way to go. What I find most interesting, though, is that another strategy that looks so promising can be explained by the same four basic building blocks.