A client called me last week and asked if I had seen an exchange traded fund (ETF) with a 20 percent yield. In fact, I hadn’t.

The client said that he was sure that the yield was phony since it was so high that it was ‘too good to be true,’ but wondered how the ETF could have such a high yield. Good question.

In this case, the product is actually an exchange-traded note (ETN). In some ways ETNS are just like ETFs, but their primary differentiating feature is that they are structured as notes so that when you own an ETN it’s like owning a bond and you have to worry about the credit risk of the issuer.

In this case, the issuer is UBS and the ETN tracks an index of closed-end funds, which are a different kind of fund entirely. To add even more excitement to the product, the ETN is leveraged so that it should earn twice the performance of the closed end funds.

And, indeed, as of Nov 30, 2014, the ETN had a yield of 19.4 percent, according to the factsheet from UBS, which you can see here.

The product, the UBS ETRACS Monthly Pay 2x Leverage Closed End ETN (that’s a mouthful; the ticker is CEFL) was launched a little over a year ago, and in the last year as of Friday, the total return was 12.24 percent, according to Morningstar.

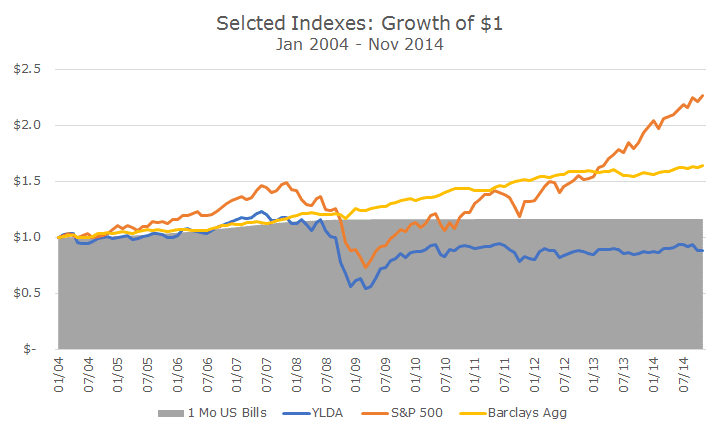

I was curious about the longer-term performance of the underlying index, the ICE High Income Index, and thought the results were superbly poor, as seen in the chart below.

I can’t say that I’ve ever seen a backtest where the index failed to at least earn what one-month US Treasury bills earned over the same period. Usually results like those are left on the cutting room floor as product providers seek out something that at least looks good since inception.

In this case, I wondered what UBS could be thinking as they launched this product, but I couldn’t find a press release that might explain their rationale.

The fact sheet does say that the ETN has ‘significant income potential in the form of variable monthly coupon linked to two times the cash distribution, if any, on the index constituents.’

I assume that means that they thought that enough people will buy it for the yield thinking that 20 percent is so high that it could support capital losses. In the backtest, that may have been true without the 2008 financial crisis, but I have to say that the results aren’t particularly compelling before or after the crisis either.

I suppose that I don’t really know what to make of this ETN, although I can say that we won’t buy it.

There’s a quote attributed to PT Barnum that comes to mind: ‘there’s a sucker born every minute.’ And, t’s too bad, really.