Although there are still a good solid two and half months left this year, the big stories in my mind are set: the horrible performance of US small cap stocks (overseas small stocks are mildly worse than overseas large) and the meaningful drop in US Treasury bond yields.

Back in May, I wrote that the Treasury bond market was a bit of a mystery because yields were falling, which is the equivalent of saying that prices are rising. I was ‘shocked’ to see that the yield on the 10-year US Treasury note was 2.545 percent (click here for the article).

Imagine how I feel today, now that the yield on the 10-year Treasury is 2.197 percent. Double shocked!

I know that everyone else in the market is feeling the same way and one of the great features on our Bloomberg terminals is that you can go back in time and see what forecasters were saying about future bond yields.

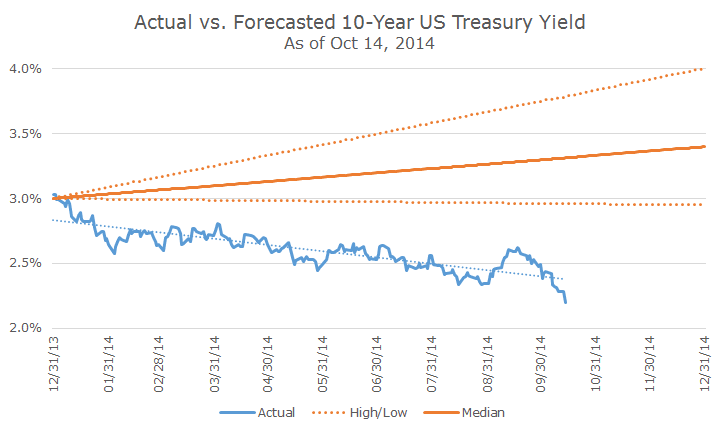

As you can see from the chart, ‘everyone’ thought that yields would rise.

Admittedly, I was in the same camp, thinking that yields would rise from 3.0 to 3.5 percent by the end of this year. Not a very controversial call given that a 0.50 percent increase was the median forecast.

The low forecast for the year was for 2.95 percent, although that doesn’t quite capture everything, because when someone forecasts a range, like Vanguard did calling for between 2.75 and 3.50 percent, Bloomberg uses the average but doesn’t include the high/low numbers.

Interestingly, Bloomberg also tracks something called the implied forward yield, which is very complicated, but essentially is a market based forecast of yields based on current prices. Back in December, the implied forward yield was 3.09 percent.

Obviously, the implied forward yield was wrong too, but it’s interesting because the market-based forecast was based on what investors were actually willing to trade on, not what forecasters were willing to jawbone on.

When a forecaster makes a call, he’s including something other than a pure forecast – the consequence of being uniquely wrong. Let’s say that your true forecast was 3.10 percent, basically matching what the market is telling you.

There’s a lot of pressure when you’re different. If the yields had gone up to 3.5 percent and your call was for 3.1 percent, you’d be a laughing stock because ‘everyone knew’ that rates were going higher. There is safety in numbers. Now everyone is wrong, but no single forecaster takes it on the chin because they were wrong collectively.

So what are they saying now? The forecasters have hastily lowered their forecasts so that the current median forecast is now 2.70 percent, with the high at 3.12 percent and the low at 2.30 percent. The market collectively, based on the implied forward yield, thinks that the 10-year will end this year closer to 2.28 percent, right along with the low forecaster.

Of course, the year isn’t over and it should be ‘obvious’ that it’s anyone’s guess where yields will go from here.