Even though the first day of fall was on September 22nd this year, it’s only when we enter the fourth quarter that I start to think about the changing leaves, shorter days, corduroy pants, flannel sheets and raking the leaves.

I do love summer, which I mentally compartmentalize into the third quarter and 2016’s was particularly enjoyable given the strong market performance across the board.

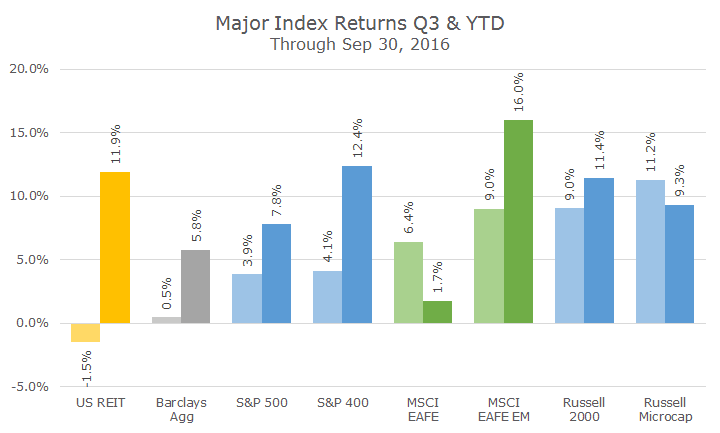

The chart below includes the returns for the eight major asset classes that we include in portfolios – four domestic indexes in blue, two foreign indexes in green, REITs in yellow and bonds in gray.

They are organized from the lowest returns for the quarter on the left to the best returns for the quarter on the right. It isn’t terribly obvious, though, because I’ve also included the year-to-date returns for each index which are a little choppier.

On the far left, for example, are REITs, which lost -1.5 percent for the quarter but are up 11.9 percent year to date. On the far right are micro-cap stocks, which gained an amazing 11.2 percent in the third quarter and are now up 9.3 percent for the year.

When I look at the chart above, I draw two main conclusions.

First, markets will surprise you. Two and a half years ago, I wrote that I thought that markets were overvalued and that we should expect lower returns in the future (click here for the article). I wasn’t calling for any changes and thank goodness because the S&P 500 is up more than 20 percent since then.

I’m also surprised by how well stocks have done this year, especially given the sharp selloff that we encountered in the first month and a half. I would not have guessed that four of the eight asset classes would be up double digits for the year by the end of the third quarter.

And for me, the most surprising gains are from bonds, even though they aren’t double digits. If you had told me that the Barclays Aggregate would be up 5.8 percent at the end of the third quarter, I would have laughed out loud. And yet, here we are.

Second, diversification is working better this year than it has in the past few, meaning that the S&P 500 isn’t the best performer. Since our founding more than 14 years ago, we’ve always advocated a well diversified portfolio across multiple equity asset classes.

The strategy has served us well overall, but has been tough over the last three years or so, especially for our foreign stock allocation. Foreign stocks look a lot cheaper at this point, but they have for some time, and developed markets are still well under the S&P 500 this year.

Emerging markets, on the other hand, are up 16 percent for the year so far. Granted, emerging markets are still well below the S&P 500 looking back over the last three or five years, but they are definitely zigging while the S&P 500 is zagging, which is the very definition of diversification.

Even though I have repeatedly complained that diversification ‘didn’t work’ over the past five years, it actually did. Yes, including anything else besides the S&P 500 hurt relative performance, but investors were still better off putting their eggs in many baskets since we couldn’t have predicted the winner in advance.

Well, we still have three more months before we can put a fork in 2016 and one thing we know is that the fourth quarter will be eventful, with the election in November and the likely Fed hike in December, and those are just the known unknowns – the real action is the unknown unknowns.

Markets will surprise you, stay diversified and hope for pretty fall colors.