Stocks enjoyed a positive finish to a tough quarter, as the S&P 500 gained 1.91 percent yesterday but was still down -6.44 percent for the quarter. It was the worst quarter for most markets since 2011 during the first phase of the European debt crisis.

Somewhat surprisingly, markets shook off weak purchasing manager data from Chicago and the onset of Russian airstrikes in Syria. Some investors believe that more stimulus from foreign central banks like the Bank of Japan and European Central Bank are forthcoming.

Although I’ve been writing about all of the problems with stocks for the last month and a half and have been talking about how the market is overvalued for at least 18 months, make no mistake: I am a raging congenital bull.

Warren Buffett is often quoted for saying that ‘it’s never paid to bet against America. We come through things, but it’s not always a smooth ride.’

I couldn’t agree more and the hiccup that we’re going through now pales in comparison to what we went through in 2008. It’s possible that things get that bad again, you never know, but it doesn’t seem like it at this point.

One of the things that behavioral finance experts tell you to think about are your own behavioral biases.

For example, it’s well documented that all investors, but especially men, suffer from overconfidence that causes them (us) to over-trade their accounts which hurts gross returns and really hurt returns net of transaction costs and taxes.

It seems to me that simply growing up in the US has made me biased towards stocks because I’ve seen them work for so long. I first became interested in the stock market in the eighth grade, which means the late 1980s.

Over that time stocks have suffered two of the five worst drawdowns in market history, but they’ve always recovered and then some, which is pretty compelling.

I’ve wondered how I would feel, though, if I had grown up in Japan, where stocks have really suffered over that same time period.

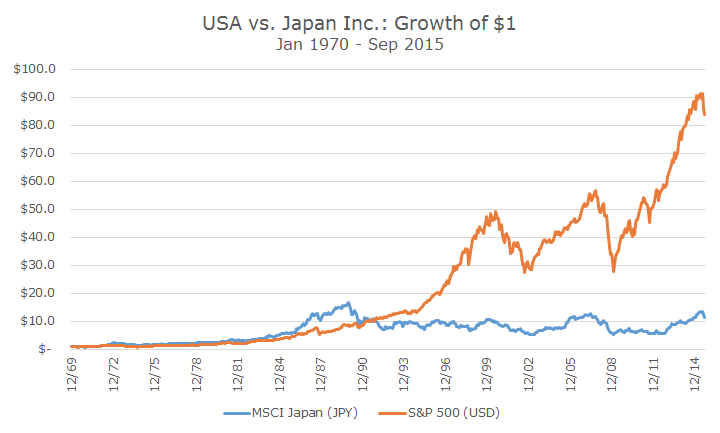

The chart below shows the growth of $1 invested in the MSCI Japan index in Japanese yen.

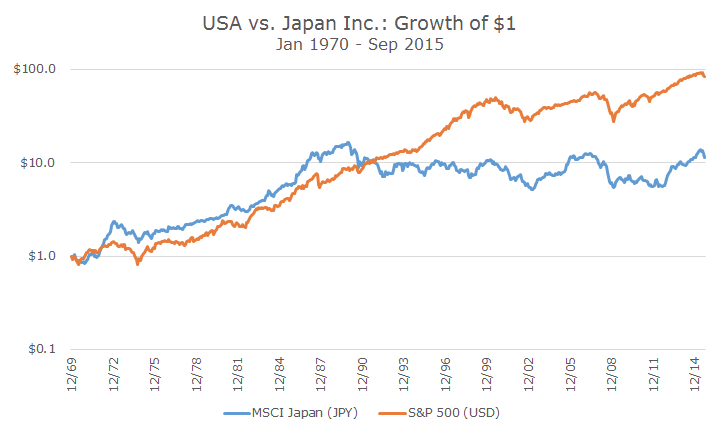

The trouble with the graph above is that it’s hard to see how well Japan did until 1989 when the economic growth miracle ended. The chart below shows exactly the same thing, but in a logarithmic scale which I think paints a more realistic picture.

The story is the same, though. Japanese stocks perform wonderfully for the Japanese investor until the bubble burst and then basically nothing happens since then.

I’m making an important distinction that those are the returns that Japanese investors earned because they held the stocks in yen, as we hold our stocks in US dollars.

US investors that bought Japanese yen fared much better because the yen has been incredibly strong over this period. The Japanese investor who held Japanese stocks in yen since 1969 had a total return of 5.46 percent (which was all front loaded in the beginning of the period).

A US investor that bought Japanese stocks did well, earning 9.24 precent over the same time period. It’s not quite as good as the S&P 500, which earned 10.16 percent during that time, but having both lowered the risk of the overall portfolio.

My point is that I am clearly biased by the fact that the US has been a wonderful place to invest during my lifetime. Like Buffett, I think that will continue to be true.

Of course, I will continue to report on whatever happens in the markets, but I want to be clear that I have a decidedly bullish bias. Of course, I know that most of our clients shouldn’t be all stocks and advocate bonds in most portfolios, but if someone asks me where I think stocks will be in five, ten or 20 years, I will always say higher.