At this point, 93 percent of S&P 500 stocks have announced their first quarter results, which means that earnings season is almost over. The expectations for earnings were relatively high at the beginning of the season, as Wall Street analysts expected that earning would grow by 11.3 percent.

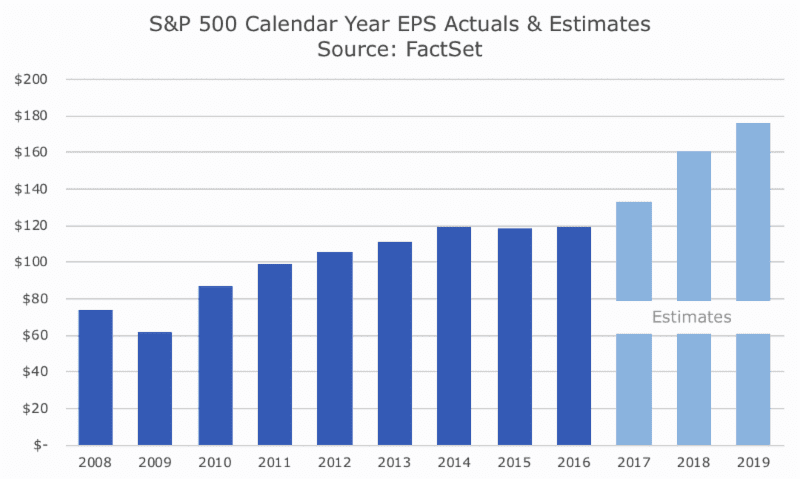

In fact, it was a blow out earnings season, with FactSet reporting that the blended average earnings grown at 24.5 percent – well more than double the expectations. Revenue, at this point, has grown by 8.3 percent from a year ago, with four sectors posting double digit revenue growth.

The market, however, isn’t rewarding the good earnings data. According to FactSet, companies that have reported upside earnings surprises have seen average price increases of just 0.1 percent, well below the average 1.1 percent gain that companies with earnings beats have earned over the past five years.

Why isn’t Wall Street reacting more positively to the unambiguously good profit and revenue news? Because investors had largely priced in the growth last year, when the S&P 500 gained 21.8 percent.

Immediately after the election, markets rose sharply on expectations that President Trump and the Republican Congress would pass tax cuts, regulatory roll-backs and infrastructure spending. At this point, Republicans have delivered on two of these three big priorities and they certainly haven’t given up on infrastructure.

To a lesser extent, markets are a little disappointed by some of the earnings guidance that companies have announced along with their first quarter results. For the second quarter, 51 companies have provided negative guidance and only 38 have offered positive guidance.

The real story, though, in my opinion, is that we enjoyed the returns last year for the policy impacts on profits this year.