I remember listening to one of my parents’ friends talk about retirement. He was proud that his tax-free income was covering all of his expenses. Although I was in a pretty low tax bracket at the time, I liked the idea of not having any deductions from my paycheck.

I didn’t know it then, but he was saying that his entire portfolio was in municipal bonds, which are generally exempt from federal income tax (naturally, there are some exceptions). Municipal bonds may also be exempt from state income tax if they are issued by an entity in the investor’s state of residence.

Muni bonds are issued by state and local governments and certain government entities, such as counties, cities, towns, school districts, and special purpose districts. Munis finance various public projects and initiatives.

There are three basic types of muni bonds: general obligation bonds (GOs), revenue bonds, and special tax bonds. GOs are backed by the full faith and credit of the issuing government entity. They are supported by the issuer’s ability to raise taxes and earn other revenue to repay the bondholders.

Revenue bonds are backed by revenue generated from a specific project or source, such as tolls, utility fees, or lease payments. Special tax bonds are secured by specific taxes levied for a particular purpose, such as a special assessment of property owners within a defined district.

We haven’t invested much in muni bonds, and the question is: Why? Why wouldn’t we want a portfolio of tax-free income?

Because we are trying to maximize after-tax returns, which is slightly different than minimizing taxes.

Here’s a simple example: Let’s say you have $100 to invest, and these outcomes are certain, and the risk is identical. Would you rather double your money and pay a 50 percent tax, or make $25 and pay no taxes?

Of course, you’d rather pick the first option because, after tax, you’ve made $50, or 50 percent. With the second option, you only make $25, or 25 percent.

Of course, it’s not so black and white in the real world, but it’s the same concept.

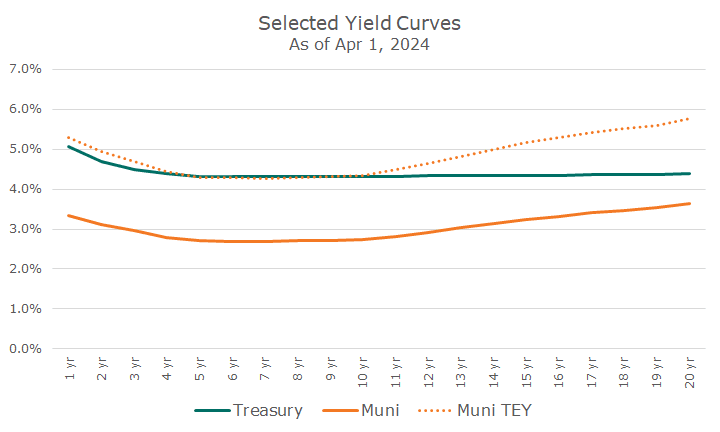

The chart below shows the yield curve for Treasury bonds as of last Monday in green. Then, it shows the GO muni yield curve in orange. And you can see the yields are much lower for the GOs, but it’s not a fair comparison because they aren’t on an apples-to-apples basis.

We must look at the muni bonds adjusted to pre-tax levels for a true comparison. We could look at Treasury bonds on an after-tax basis, too, but that isn’t the industry convention for reasons I don’t know.

The orange dotted line shows the muni yield curve on a taxable equivalent basis to Treasury bonds.

Now that we know what to look at, the curves are much closer together.

At the short end of the curve on the left, the TEY on muni bonds is slightly higher than that of Treasury bonds. Then, they are about the same from three to ten years. Beyond that, muni bonds offer much higher yields than Treasury bonds on a TEY basis.

We’re not interested in adding bonds that mature in more than ten years – we’re a little more focused on the short end of the curve right now than the long end. So that explains why the very long muni bonds don’t appeal to us right now.

But shouldn’t we take the extra yield at the short end? It isn’t much, but it’s something.

First, remember that the TEY curve I’ve shown is for those in the 37 percent bracket. It’s not a close call for anyone in lower brackets, which is most people, since you must make $730k in taxable income for couples filing jointly ($609k for single filers).

Second, muni bonds have some risks that Treasury bonds don’t, so that tiny extra yield isn’t worth it.

First, muni bonds have more credit risk. I’d rather lend money to the Federal government than, say, the state of Illinois, which has the worst reputation among muni investors (but S&P says it is A-, up from BBB+).

Our own great state is AAA, according to S&P, which is better than the federal government at AA+. Still, the Feds have a printing press and a military, so I think they’re safer (it all gets a little nuts, doesn’t it?).

The second big risk is that muni bonds are less liquid than Treasury bonds, which are probably the most liquid bonds in the world. There are thousands of municipal issuers, and they don’t trade at the same depth as Treasury bonds.

We regularly keep an eye on muni bonds in case something changes, and we do use them for some clients in the top bracket because there is a diversification benefit. Unless something changes, though, we probably won’t be backing up the truck anytime soon, despite the innate appeal of tax-free income.

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott