In the first few years after the 2008 financial crisis, a lot of investors were excited about emerging markets.

The story making the rounds at the time was that the US and other developed markets were in for a long period of sluggish growth while the prospects for economic growth in emerging markets were still strong. Therefore, the story went, investors should allocate money away from the US stocks into emerging markets stocks.

Well, part of the story worked out – Gross Domestic Product (GDP) has been sluggish in the US and other developed countries. According to data from the IMF, developed market economies grew at an annual pace of 1.83 percent in the five years ending in 2014, while emerging market economies grew by 5.67 percent over the same time period.

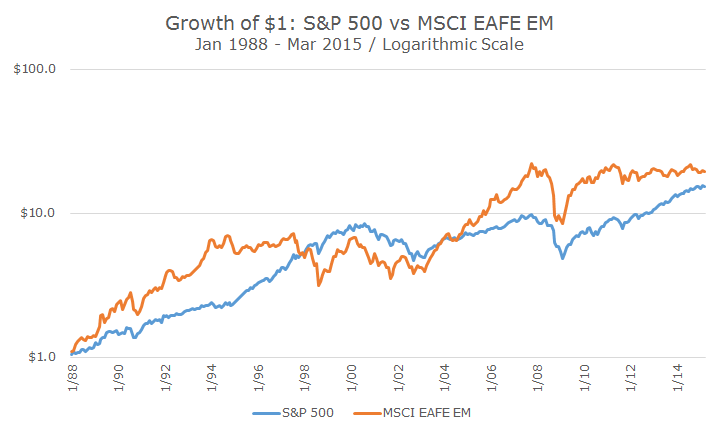

Stocks were another story: while the S&P 500 gained by an annualized rate of 15.45 percent over the same period, emerging market stocks as measured by the MSCI EAFE EM index have grown at a paltry rate of 2.11 percent. The cumulative returns are dramatic: a 105.1 percent gain for the S&P 500 compared to 11.0 percent for the MSCI EAFE EM.

In addition to the poor stock returns over the last five years, pundits are worried about emerging markets because the US dollar is strong, commodities are weak and the Federal Reserve is on the verge of raising short term interest rates.

The strong dollar has traditionally been a headwind for emerging markets because emerging market economies generally rely on money from the developed world to sell their public and private bonds as well as finance their imports.

Lower commodity prices hurt because a lot of emerging market countries are often large commodities producers. Russia, for example, needs oil to trade above $100 per barrel in order to balance their budget. With oil currently trading at a little more than half that level, they won’t have the revenues they need to cover their expenses.

Higher interest rates in the US reverberate in the emerging markets for several reasons. First, higher rates here make rates elsewhere less attractive on a relative basis – the spread decreases. If US investors pull back on emerging market investments (stocks or bonds), capital flows out of emerging markets, exacerbating the currency problem.

Before you get too nervous about your emerging markets position, it’s worth noting that these countries are much differently managed today than they were in the 1990s (remember the Asian Financial Crisis in 1997?).

For one thing, external debt as a percentage of GDP is much lower than it was before. For example, when Russia defaulted on their bonds in 1998, their external debt to GDP ratio was nearly 65 percent and today, it’s down to 35 percent.

Most countries also have much larger currency reserves compared to their external debt. In 2002, when Brazil fell apart, it only had reserves equaling 16 percent of external debt, and today that number is nearly 75 percent.

Perhaps the improved conditions are what’s propelling emerging markets forward so far this year. As of yesterday, the MSCI EAFE EM is up nearly 10 percent, well ahead of the US so far.

That’s part of what we like about emerging markets – the diversification benefit of two types of stocks that really have different returns streams. In statistical terms the average correlation between the two markets is about 0.66 since the index was launched, but a casual look at the chart above tells the story just as well as the single data point.

Even though emerging markets have struggled in recent years, we still believe it’s a great addition to the portfolio because it adds to diversification and because of the political uncertainty, we do expect higher returns of time since investors like us require higher returns as compensation for higher risks.

The moment that emerging markets aren’t riskier than the US, we won’t find them appealing anymore, but the key is to take the benefits in small doses.