The selloff in stocks yesterday was a little different than what we’ve seen so far this month, both in terms of its magnitude, but also its suspected causes.

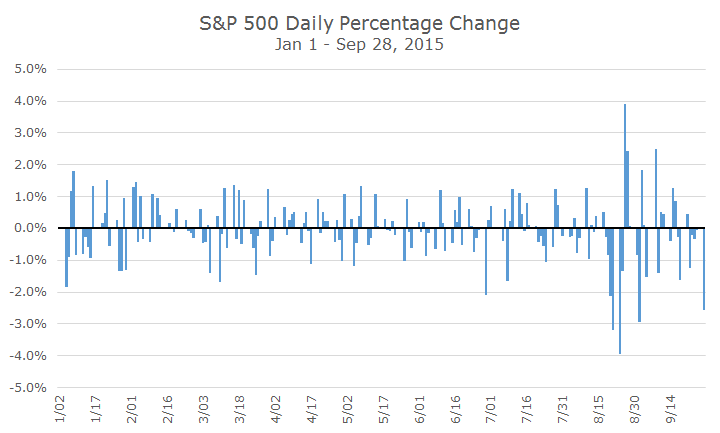

Last month stocks sold off more sharply than they did yesterday, but things had quieted down a little bit, as you can see in the chart below.

When stocks fell last month, the concerns were macro in nature: the slowdown in China, oil hitting multi-year lows, uncertainty about the timing of the Fed’s increase in interest rates and slowing global growth.

The catalysts yesterday were much narrower: sharp losses in a large Swiss mining company.

Glencore PLC was once a commodities related hedge fund, but starting in the late 1980s, Glencore branched out and started to buy mining, smelting and refining companies. In 1994, the management of the company bought out the original founder and shifted from trading to mining.

By the time Glencore went public in 2013, it was worth $60 billion, was the third-largest family owned company in the world and was the largest producer of copper, zinc and other commodities.

The plunge in commodities prices has hit Glencore particularly hard because it was aggressively run with a high debt load. Now, investors are worried that Glencore won’t be able to pay their debts. The cost to insure $10 million in Glencore debt was $154,000 in January. Today, the same insurance costs $790,000 – a 412 percent jump.

Although they are still considered investment grade with a BBB rating, the market is treating them like a CCC credit rating (evidence that market prices are much more efficient than ratings agencies, a topic that I wrote about when I first started and bears repeating one of these days).

As a result, the stock fell by more than 29 percent yesterday and is now down 85 percent since the initial public offering (IPO). The market capitalization, which was $70 billion at the peak, is now $9.8 billion.

The company already started restricting a few weeks ago by cutting the dividend, selling assets, issuing stock and repaying debt. At this point, the market has concluded that even these aggressive actions won’t be enough and they may have to do more.

In my opinion, the selloff yesterday was a little less off-putting than what we saw at this time last month, for two reasons. First, the trading was clean yesterday, unlike when the Dow Jones fell by 1,000 points and many stocks and ETFs traded in a sloppy, chaotic fashion (more details here).

Second, the most widely accepted catalyst, problems with Glencore, is a very narrow problem in the overall market-wide context.

Of course, there are other issues, like the continued selloff in biotechnology stocks, which are off by more than 25 percent since mid-July. And it’s not like the issues with China, Fed uncertainty, low oil prices and slow global growth have gone away.

But, overall, I think the decline yesterday based on Glencore’s problems highlight the general nervousness in the markets. Things aren’t much different from what I suggested last month, which is that big drops portend a lot of volatility, but don’t necessarily say anything about stock prices.

Keep in mind that even with yesterday, we’re basically even with where we were a month ago after the big drop. It’s just that it’s been a wild ride and just when things seemed to be cooling off, we’re back in the middle of it again.