Last year at this time, deep fears about China’s economy caused US markets to drop sharply. The Shanghai market -8.5 percent one day drop spread to our shores and the Dow Jones Industrial Average (DJIA) fell -1,000 points in a single day.

The week before, markets that had dropped by the massive one day plunge sent all of the stock market indexes into a correction, generally defined as a decline of -10 percent.

My headline read, ‘This is Investing, So Stock With It,’ and I tried to argue that the drop meant higher volatility, but not necessarily lower returns – sometimes volatility spikes meant lower markets, but just as often, higher markets followed.

Well, things could have turned out differently, but this time, the sudden drop in prices last year and corresponding spike in volatility did not portend lower returns.

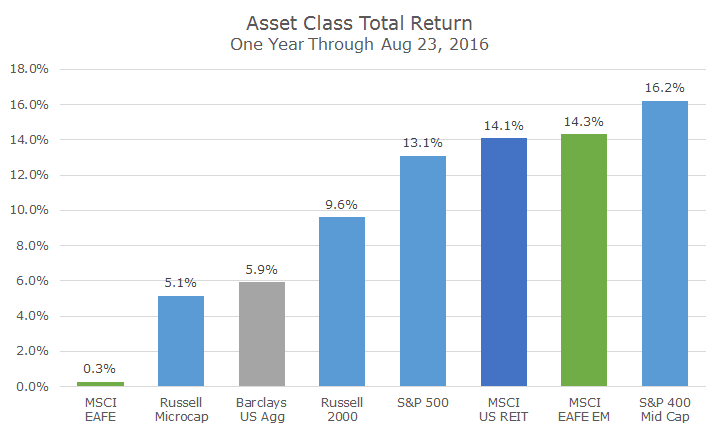

The chart below shows what happened to the major market indexes and, in my view, the results were pretty darn good, ranging from 0.3 percent in developed markets to 16.2 percent for US mid-cap stocks.

Who would have guessed a year ago that the S&P 500 would have posted double digit gains along with REITs, emerging markets and mid-caps? The Russell 2000 small cap index is nearly 10 percent and a variety of other small cap indexes are well into double digits.

Last year, I said that the heightened volatility and sharp drop was investing. Thank goodness, so was the last year.