When US Treasury bills first traded with negative yields in 2008, I took a screen shot, printed it and put it in a folder of interesting stuff that I look back at every few years. I never dreamed that interest rates would be negative all the way out to 10-years in Europe.

Well, it turns out that it’s not just interest rates that can trade completely upside down – yesterday people that owned oil were willing to pay buyers up to $38 per barrel to take oil off of their hands. Weird, right?

Early this morning, it was reported that oil fell 40 percent overnight, and not because of a fight between Russia and Saudi Arabia, like last month.

In that case, the Saudi’s created an oversupply of oil to sink the price and put economic pressure on Russia. In this case there is a problem with demand since the whole world has dramatically cut oil usage as we globally shelter-in-place.

That’s the big picture problem, but that doesn’t explain why oil prices would be negative. It gets a little technical, and I’m not going to fully describe all of the details, but the basic issue is that oil is a commodity, a real asset in the physical world.

When someone buys a futures contract on a barrel of oil, they have to take delivery of the oil when the contract expires. The contract for taking delivery in the month of May expires on Tuesday,

As demand slowed down, oil supplies at refineries, storage facilities, pipelines, and ocean tankers started to build since 100 million barrels a day are still coming out of the ground.

In a sense, no one wanted to take the delivery in May because there’s no place to put the oil. If you had a tanker sitting around, of course, you’d want to take in as much oil as you could at super low prices.

But if your tankers are already full and you have no place to put the oil, you’re willing to pay someone else to take it off of your hands.

I suspect that in a week or month, we’ll read about a large fund that got wiped out today. I doubt that anyone’s risk models assumed that the price of oil would turn negative, let alone negative by such a large degree.

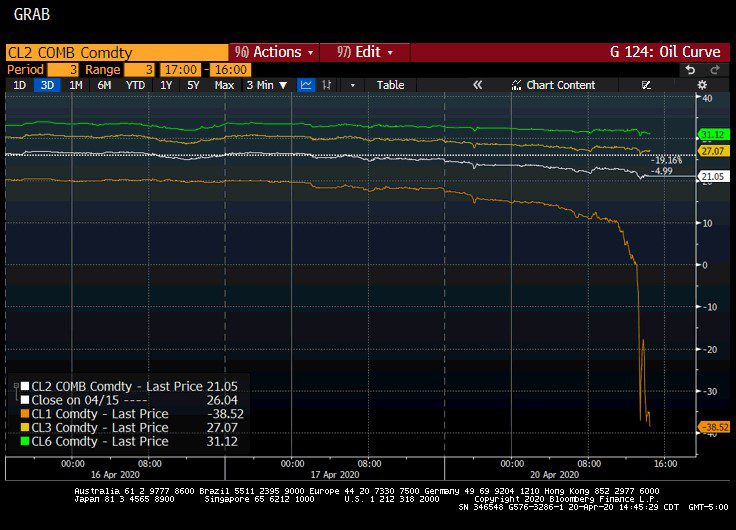

And, it’s important to note that right now, the other contracts look fairly normal. Last night, www.marketwatch.com showed that the Jun contract was trading around $21 per barrel, the July was $27 per barrel and the August contract was $29 per barrel.

And here’s a chart from Bloomberg yesterday that shows the prices of a few contracts:

That implies that the market will get back to normal and that this is a technical glitch. That said, if production continues unabated and demand remains weak, we could find ourselves in the same situation next month. It turns out that turning off the oil spigot isn’t a simple matter, functionally in the field or financially speaking.

What it really shows is that the stress on energy complex is very high right now. I’ve argued that the stress on financial system is lessening, and will show some data to that effect tomorrow.

Of course, the real question is when we will start to get paid to get gas at the station, like being paid interest to take out a mortgage in a negative rate environment. We know the answer to both of those questions, but that goes to show how strange this all is right now.