One of the best decisions that our Investment Committee made was back in 2008 when we decided not to add commodities to the portfolio.

It’s hard to believe now, but there was a lot of pressure back then to add it because stocks were down and commodities were doing well.

If you look at the 12-month period ending on June 30, 2008 just before the worst part of the storm, stocks were down -6.7 percent, broad commodities were up 17.6 percent and oil was up 98.1 percent. Goldman Sachs predicted a forthcoming ‘super-spike’ in prices.

Of course, nobody said at the time that they were performance chasing, the story was about diversification, and the low correlation between stocks, bonds and commodities. And if it’s been a while since you’ve had Finance 101, low correlation lowers overall portfolio volatility.

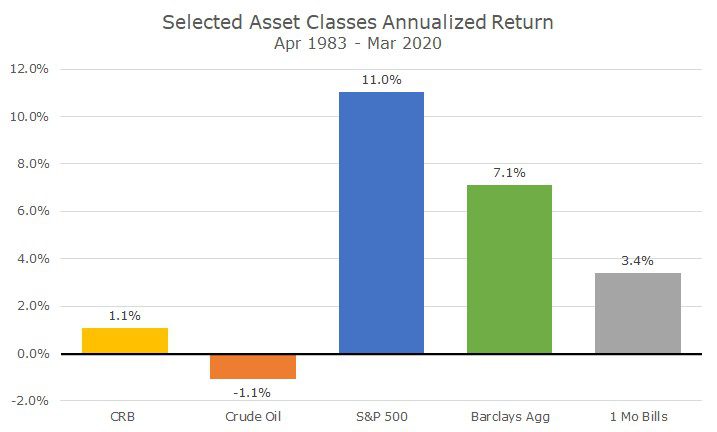

We talked about it, fairly seriously, but we couldn’t get over the lousy returns and high volatility. I’m going to start by showing you the data through now (since it was late when I started and didn’t know exactly what I was going to say), but here are the returns from 1983 through today:

The CRB is a broad basket of commodities that is somewhat evenly weighted so that it isn’t overwhelmed by oil (which, by value, dominates). Neither broad commodities or oil kept up with Treasury bills, the equivalent of cash, let alone stocks or bonds.

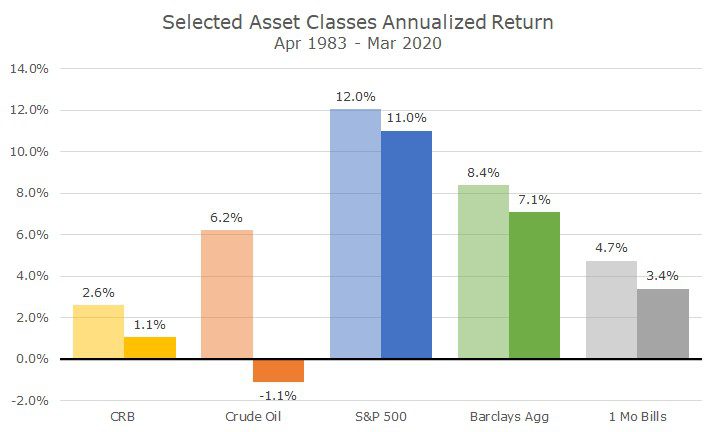

Now, here’s what those returns looked like back in 2008 when we were trying to make our decision:

The shaded numbers show the returns through June, 2008, and you can see that everything looks a little better, but broad commodities still under-performed cash and oil had lower returns than bonds.

We were confident that bond returns weren’t going to be as high going forward, so maybe oil would be competitive, but that’s not how it turned out.

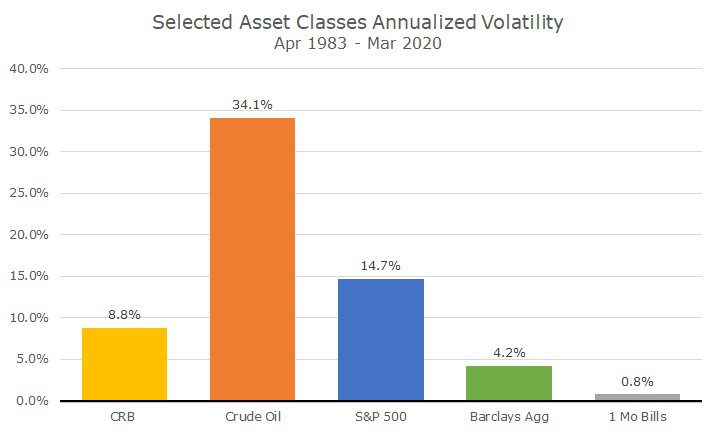

But here’s another problem: despite the low returns, commodities have extremely high volatility.

Wow! Oil is 2.3 times more volatile than stocks! The broad-based basket is less volatile, but even back in 2008, the historical record of returns was less than cash.

We concluded that the low correlation wasn’t worth it. Yes, it may lower portfolio volatility, but the cost of that reduction wasn’t worth the price of admission, especially knowing what happened.

I remember Ryan Craft saying in the meeting, ‘Guys, a jar of dirt doesn’t have any correlation to stocks and bonds either, and we know that’s not a good investment.’ So true. Thank you, Ryan.

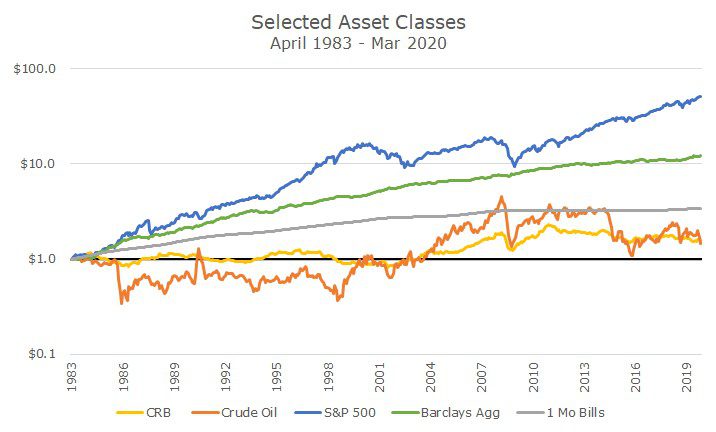

And, just because I made the chart, here’s a look at the growth of $1 invested across these asset classes over time.

And, the amazing thing is that this chart doesn’t even include the carnage this month. Maybe things will get better in the next seven trading sessions.

This story may be familiar to longtime readers, since I told it in 2014, and you can enjoy it again by clicking here. I didn’t mention the jar of dirt in that one, and wonder what my friend is doing about his commodities allocation now. I think I might wait a few months to call him; he may be busy.