Investment strategies can be trendy.

After the tech bubble, real estate investment trusts (REITs) were the rage. Then, just before the 2008 financial crisis, fundamental indexes, which weight stock positions by fundamentals like earnings, took hold. After the 2008 crash, managed futures and other alternatives were all the buzz. Then, it seems like the world couldn’t have enough factor funds.

Now, the hottest thing going in the investment business are private investments: private equity, private real estate, and private credit. There’s nothing new about these asset classes, they’ve existed for years. And, you can find public market equivalents. So why are private investments so hot?

Proponents of private market investing tout the high returns, low volatility, and low correlation to public markets – all of which improve the characteristics of a portfolio. There’s also the diversification argument – even if you own every publicly traded stock, you can have more stocks by adding privately held ones, which lowers your exposure to the public market stocks without reducing your stock allocation.

Critics of private investing argue that the funds are expensive, opaque, illiquid, probably don’t offer better returns and the lower volatility and correlation are bogus because those things are features of pricing the security once per month or quarter – and worse yet from the critic’s viewpoint, the private market managers set their own prices.

As I’ve said many times before, we at Acropolis eat our own cooking: we own what our clients own. As the Chief Investment Officer, I view my account as the test kitchen for our strategies, which means trying things out to see how they work and if they might work for clients.

Sometimes what I find in the test kitchen is so awful and you can find me choking, and sometimes it’s so delicious that they end up for everyone to feast on. Said another way, I bought a private credit fund in 2019 to see how it worked.

The result is interesting and highlights the different nature of public and private investing because this particular fund went public at the end of last year, so this single investment can be viewed from a private and public standpoint.

Credit, public or private, is simply lending money without certainty of repayment. With the US government, you don’t have to worry too much about the credit risk because they can always pay you back by printing more money. A private company doesn’t have that option. Therefore, all corporate bonds are considered credit, but some governments are too.

In theory, private credit can be any kind of lending, but it usually means the kind of loans that can’t get done in the public markets. Private credit was once the domain of banks, but the regulatory requirements that banks faced have changed since the post-2008 financial crisis.

If banks and public markets can’t facilitate these loans, you should infer that they are riskier. And, in exchange for the risk, the yields are higher. As always, risk and return go hand-in-hand, and the higher yield is compensation for bearing risk.

In the private markets, that risk doesn’t show up in the price each day. Private market investors get their portfolios priced at the end of the month or quarter. In the public markets, the pricing happens every moment of every trading day.

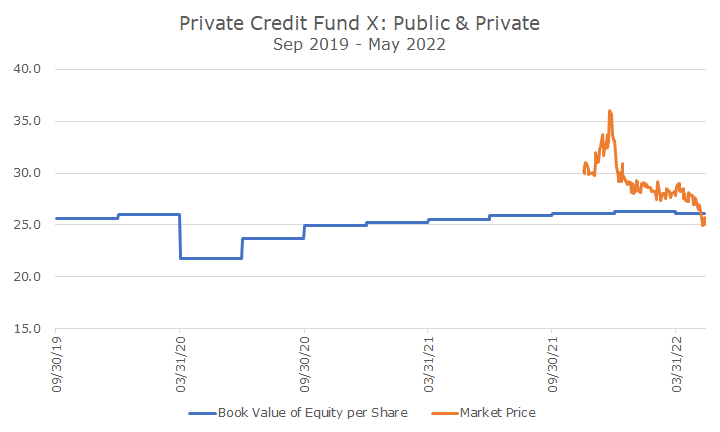

As noted earlier, the fund that I bought, which I’m calling Private Credit Fund X, was private and went public. The chart below shows the private and public market prices for the fund since I bought it.

The blue line is the book value of the equity, on a per share basis. When the fund was private, that was the price. You can see that the loans were marked down substantially after covid hit, so it’s not the case that private markets go unpriced.

You can see that the equity is still published, but there is now a public market price, which is in orange. After the IPO, the price rose steadily, then backed off, and has drifted lower. At the IPO, the fund traded at a substantial premium to the book value but now trades at a modest discount.

The obvious question is, which price is right?

The answer isn’t obvious in my opinion. If you define the question as which price can you transact with, the answer is obvious – the market price. For critics of private markets, this is their answer. If you have to trade, the only price that matters is the price you can get in the market.

But does the market price reflect the true value of the assets? That’s the harder question. Think of Mr. Market, the character from the Ben Graham allegory who offers you a price every day to trade, but is bipolar and offers prices that are wildly too high and too low.

There is also work by Nobel Prize winner Robert Shiller, who calculated the present value of the market after the fact using the known earnings and dividends, and found that market prices move far more than underlying changes in value.

On the other side is Gene Fama, father of the Efficient Market Hypothesis (EMH), which is the foundation of index funds. His view is that the market price is the best estimate of the actual value because there are tons of informed investors who weigh in on the price/value question with their own money in competition with each other.

That makes sense to me, but I also have trouble reconciling it with my Private Credit Fund X. How could it have been worth 30 percent more than the underlying assets at the start of the year and five percent less than the assets now? Or, if we assume that the market value of the price reflected the value of the underlying assets, did they really go down 30 percent this year? That doesn’t seem likely either.

This puzzle isn’t new. There’s a type of security called a closed-end fund that has a fixed number of shares and trades in the market. The prices often trade at a premium or discount to the stated value of the assets, just like with my fund. Academics have studied the problem since the early 1970s, and don’t have much of a conclusion other than to call it the ‘closed-end fund puzzle.’

My answer is somewhere in the middle. I think market prices go too far to the up and downside, but that doesn’t mean that it’s easy to figure out a strategy to beat the market. If there was, we’d trade closed-end funds, buying at discounts and selling at premiums. Alas, it’s not that simple.

As far as private markets are concerned, I think that people should not buy them for the low volatility or low correlation ‘benefits.’ If you think the private market managers can do better than the public market manager, that may be a reason to own them, but picking managers in the private market is just as hard or harder than in public markets.

I’m dubious about private funds because there are periods when you can’t sell them. Funds that offer monthly or quarterly liquidity, stop offering the liquidity when too many people want their money at the same time, usually when there is a problem in the market.

If the underlying assets can’t be sold easily, which is a defining element of private investments, managers can’t offer liquidity to everyone all of the time or they will have giant fire sales when they try and liquidate illiquid assets en masse. I’m not at all convinced that all of the people buying these funds today really understand that, and there will be a lot of angry disappointment when people can’t access their money.

In a funny way, that’s also a feature of private markets. Private investors can make investments that public investors can’t because they know they can liquidate on their terms, not their investors. That’s part of where the excess return should come from. That said, I’m not sure how happy people will be to hear that argument when they can’t get their money. It’s one thing in theory, and another in practice.